February 2023 – 2023 Outlook

February 15, 2023

Dear Investors and Friends,

The purpose of this letter is to discuss RCM’s outlook for the fixed income market and, more generally, inflation and the economy over the next twelve months.

Near Term Fixed Income Expectations by Category

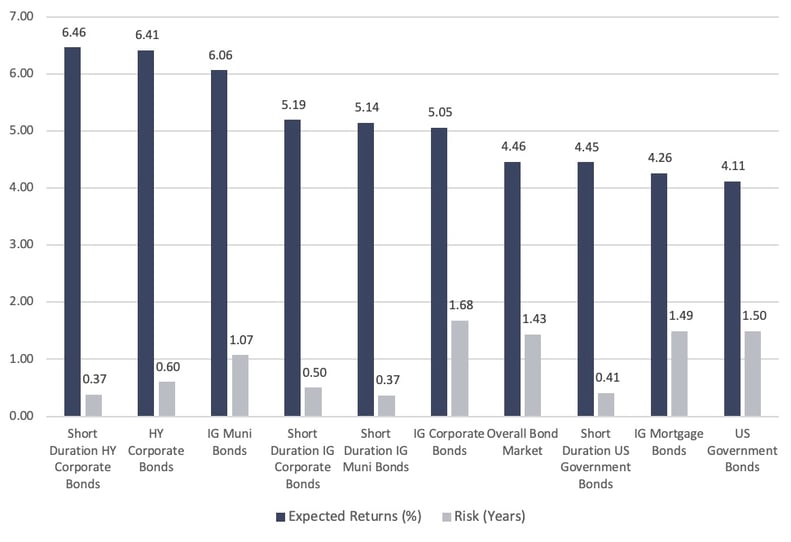

Based on our current analysis and research, we expect Short Duration High Yield Corporate Bonds (far left in chart) to outperform all other sectors and the Short Duration US Government bonds (3rd from right) will continue to outperform longer dated Treasuries particularly when accounting for risk. We continue to recommend that fixed income investors allocate funds to Short Duration High Yield Corporate Bonds in situations where the funds are unconstrained by near-term cash needs and to Short Duration US Government Bonds where the investor does have near-term cash needs. These two sectors simply offer a better risk / reward combination than any of the other potential fixed income investments today.

Expected Bond Market Performance by Sector as of February 14, 2023

Key Assumptions

The expected returns assume stable interest rates and credit spreads. Because the future is unknowable, we also focus internally on, and present in the chart above, a risk number. “Risk in Years” is a proprietary RCM metric; it is a measure of how long it will take to recoup losses for a 1% increase in yields. Using US Government bonds on the far right as an example, if their yield were to go up by 1% to 5.11%, their price will go down and it would take approximately 1.5 years to recoup the mark-to-market losses incurred.

Inflation Expectations

In RCM’s view there is a very high probability that inflation over the next year runs higher than market expectations of 2.8% as measured by the spread between TIPS and non-inflation protected Treasuries (For more about how TIPS work, please read RCM’s May 2021 letter). We believe the expectations of the market are too low. History suggests that once inflation becomes elevated it can take far longer to return to normal levels than most expect. Here are just a few data points to provide some additional perspective:

- Consumer Price Index: On Tuesday, February 14th, the Bureau of Labor and Statistics released the latest Consumer Price Index data. The CPI rose 0.5% month over month, the most in three months, and the annual rate of inflation was higher than expected at 6.4%.

- Continued Strength in Job Market: The unemployment rate in the US is at a 53-year low at 3.4%.

- Historical Analytical Context: Research Affiliates published a thoughtful, well researched and analytically robust article in November 2022 titled “History Lessons: How Transitory Is Inflation.” You can find it by clicking here. In this work, the authors studied how inflation subsequently behaved after surging above 4%. They reviewed 52 cases in 14 OECD developed-economy countries from January 1970 through September 2022. The punchline of their research is the following: “Given the recent US inflation rate, which has been above 6% for the last 12 months and above 8% for the last 7 months, history tells us that the median number of years to reduce inflation below 3% is 10 years, with a 20 to 80 percentile range of 6 to 19 years.”

Is it possible for inflation to fall from an annualized rate of 6.5% to average 2.8% over the next year? Sure, anything is possible. But is it likely considering historical norms? It seems unlikely.

Economic Expectations

While the Fed was behind the curve at the beginning of this inflationary cycle, and arguably is falling behind again with the last hike on February 1st only being 25bps, Jerome Powell has stated emphatically that he will do what is necessary to bring inflation back to 2%. The consequence of higher inflation for longer would be higher interest rates for longer. The result of higher interest rates for longer would be an increased probability of recession. The result of an increased probability of recession would mean an increased probability for the sell-off in credit spreads and equities.

How RCM is Positioning Client Portfolios

Even with the unprecedented backup in rates, investors are still not being fully compensated for taking interest rate risk considering the inverted yield curve, uncertain inflation, and the possibility for higher rates. As a result, when it comes to rates, RCM continues to position clients defensively in short duration portfolios. For our cash management clients, the Fed is offering investors a gift and wonderful optionality with 1 to 6-month Treasuries yielding north of 4.5%. For RCM’s unconstrained clients, short duration high yield bonds continue to offer the best risk / reward, although we remain vigilant in managing and monitoring default risk given the heightened probability of recession. In all strategies, RCM’s repeatable and proven processes for security selection and portfolio optimization should allow us to meaningfully outperform the market over the medium to long term.

Please reach out to us with questions and comments. Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

Dave and Mike

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the values, calculations or assumptions and encourages each prospective investor to conduct their own review of the audits, values, calculations and assumptions.

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)