September 2023 - Do TIPS Bond Funds Hedge Inflation? Yes, But…

September 27, 2023

Dear Investors and Friends,

Inflation, the subtle force that erodes the purchasing power of our hard-earned money, is ubiquitous as it is insidious and silently permeates the fabric of our daily lives. Hedging against inflation is prudent and many people attempt to do so by buying funds that hold Treasury Inflation-Protected Securities (TIPS). The purpose of this letter is to evaluate how TIPS bond funds performed as a hedge against inflation during the most inflationary period in the United States over the last 30 years. We believe most readers, including those who own TIPS or TIPS funds will be very surprised by the results. For those that are unfamiliar with TIPS and how they work, we have provided a brief primer at the end of the letter.

Inflation

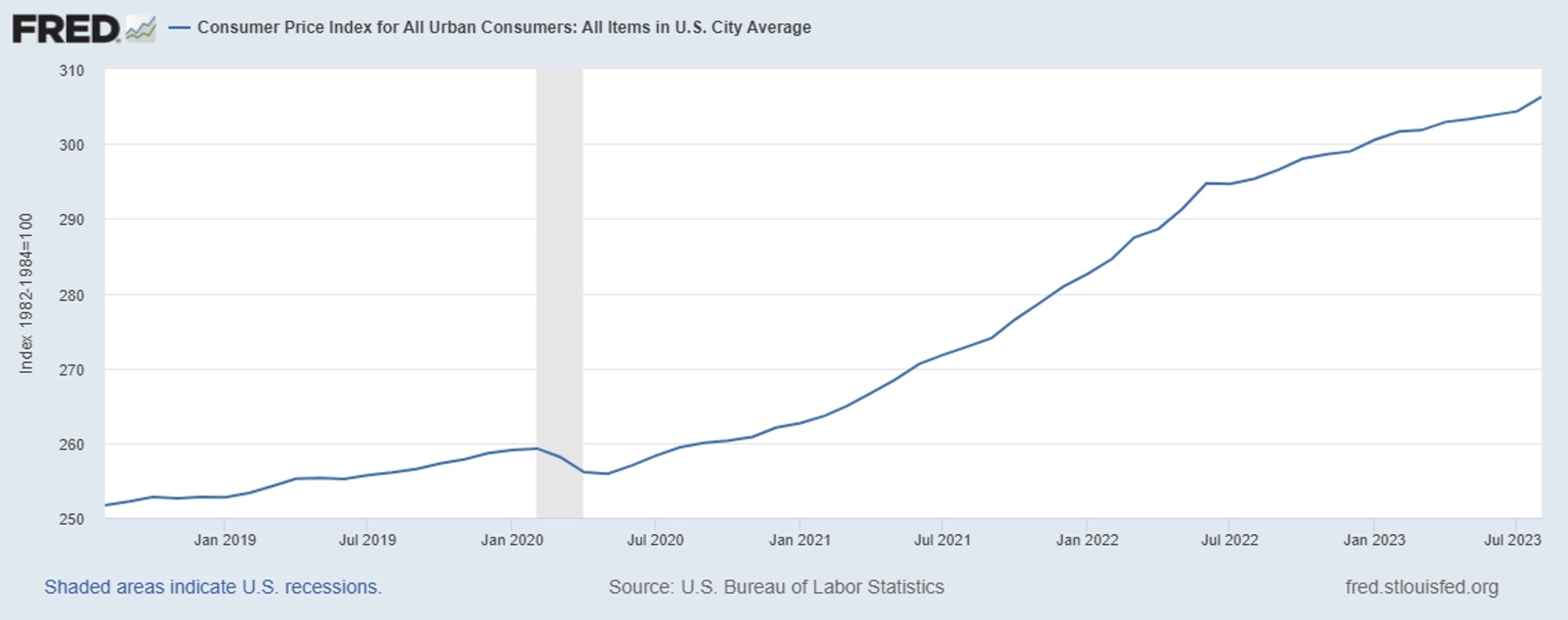

Below is a chart of the CPI Index from FRED. As you likely know, CPI stands for Consumer Price Index. It is one of the primary measures of inflation for the United States and is generated by the Bureau of Labor Statistics.

As you can see, inflation accelerated beginning in December 2020. The actual level on 12/31/20 was 260.474 and was last 307.026 on 8/31/23. This equates to an increase of 17.87% over 2.67 years or an annualized increase of 6.37%. How did TIPS bond funds perform over the same period?

An Inflation-Protected Bond Fund: VAIPX

VAIPX, a Vanguard product, is one of the largest inflation-protected bond funds in the market with an AUM more than $30 billion. The fund invests in Treasury inflation-protected securities and seeks inflation protection and income consistent with Treasury inflation-protected securities. The fund invests in dollar-weighted bonds with an average maturity of between 7-20 years.

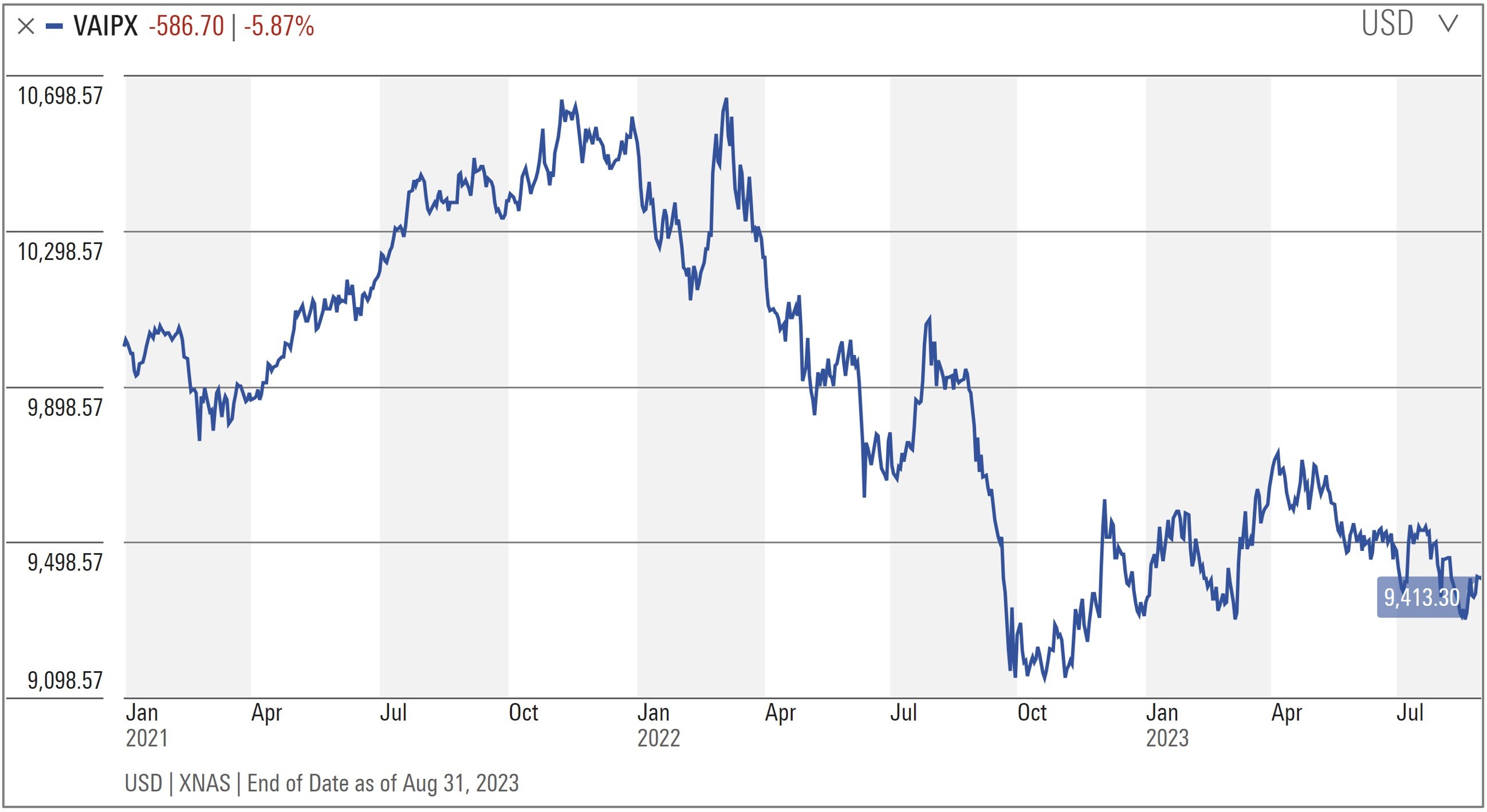

How did an investor in VAIPX do over the same period when inflation had an annualized increase of 6.37%? Please see the Total Return Analysis from MorningStar (https://www.morningstar.com/funds/xnas/vaipx/chart) below.

Even a glance at the chart shows a decline in value over the same period. Specifically, it shows that an investor in VAIPX lost 5.87% over the same period, for an annualized loss of 2.24%.

How can that be? In a high inflationary period in the United States when inflation increased at an annualized rate of 6.37%, investors in VAIPX lost 2.24%, for a total annualized underperformance of 8.61%. We believe it’s fair to assume that most investors in VAIPX expected, given the fund’s stated objective, that it would perform well in times of high inflation. Why did it not?

Inflation protected securities have many facets, inflation protection being only one of their many characteristics. Even though inflation protected securities are protected from inflation (their principal amount is indexed to the CPI Index, so interest and principal payments increase as inflation increases), they are still subject to interest rate risk, among others. In the case of VAIPX, the loss from owning a basket of relatively longer duration securities significantly overwhelmed the benefit that came from the fact that the securities were inflation protected.

A Shorter Inflation Protected Fund: VTAPX

What if an investor invested in a shorter duration inflation protected ETF? VTAPX, the largest inflation-protected fund in the market with an AUM of $38 billion, also invests in Treasury inflation-protected securities but in bonds with an average maturity of less than 5 years. An investor in VTAPX gained 4.54% over the same period for an annualized gain of 1.68%. While VTAPX’s annualized return surpassed the longer-duration VAIPX by 3.92%, it still lagged inflation by 4.69%. Even though VTAPX has a shorter duration, it is still subject to interest rate risk.

The Best Way to Hedge Inflation With TIPS

If one’s goal is to hedge inflation while minimizing interest rate risk using TIPS, the ideal way to do so is not to buy a TIPS fund but rather to buy the TIPS bond with the nearest maturity to today and continuously roll-it. The short duration nature of the bond reduces interest rate risk to the largest extent possible but completely maintains the inflation hedge component of the bond.

Key Takeaways

The are several important high-level takeaways from the above that apply far beyond just inflation and the TIPS market. A few of them include:

- When contemplating an investment in any product the first question to ask yourself is, “does the product do what I think it is designed to do?”

- Before investing in a product understand the different variables that may impact the return and the return’s sensitivity to each.

- While funds can be wonderful, ask yourself if it’s possible to invest directly in the underlying securities and whether there is a benefit to doing so.

A TIPS Primer

A deep dive into TIPS bonds is beyond the scope of this letter but developing a quick conceptual understanding is not so difficult and may be best achieved through an example. On September 26, 2023, a 12-month TIPS bond could be purchased with a yield-to-maturity of 3.12%. At the same time, an investor could buy a non-TIPS Treasury with the same maturity for 5.44%. The difference in the yield on these two bonds is 2.32%. Assuming both are held to maturity, why would anyone buy the lower yielding TIPS bond?

The answer is the key to understanding TIPS bonds. When the TIPS bond comes due in a year’s time, the U.S. Government will pay not only the par value of the bond but an additional premium equal to the change in the CPI over the period. Critically, the market prices it’s expectations about future inflation into these two yields. In this case, the market is signaling that it expects CPI to be 2.32% higher over the period. So, if inflation is more than 2.32%, the TIPS investor who holds the bond to maturity will benefit from the higher CPI and achieve a higher return than the non-TIPS investor. If it’s less than 2.32%, the non-TIPS security will have a higher return.

This simple but still real-world scenario provides a two key lessons about TIPS:

- When buying a non-inflation protected security there is an expectation of future inflation priced into the yield, and

- One benefits from buying a TIPS bond IF inflation is higher than what the bond market is already pricing in.

Please reach out to us with questions and comments. Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the values, calculations or assumptions and encourages each prospective investor to conduct their own review of the audits, values, calculations and assumptions.

- February 01, 2026 (2)

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)