September 2022 - CDs, Cash Management and the Benefits of U.S. Treasuries

September 27, 2022

Dear Investors and Friends,

The Federal Reserve raised interest rates 75 basis points last Thursday, the third time in a row that they have done so. While the market expected the hike, what it did not expect was the hawkishness of the Fed’s dot plot signaling there would be more aggressive hikes to come. The result - stocks have continued to sell off and the yield curve further inverted. Both of these trends signal the market’s ongoing bias towards a hard landing.

Inflation is rampant. The Fed is still playing catch up. Politicians, both locally and globally, continue to pass legislation that exacerbates already overheated economies. In times like these, many investors simply want to sit on the sideline and hold cash and, one of the most popular products investors utilize when they are in this position, is the bank certificate of deposit (CD). The purpose of this letter is to do a dive deep into bank CDs and compare them to an often-overlooked alternative that generally offers better returns, equal to or better protection of principal, and much improved optionality. One important note to our readers that are also familiar with brokered CDs; this letter does not address those products directly although many, but not all, of the same principles apply.

Bank CDs

A bank certificate of deposit, or CD for short, is a bank savings product. In exchange for depositing a specified amount of money into an account for a specific period, the bank pays a fixed interest rate that is typically higher than a checking or savings account. Given the current market, should you invest or re-invest in a CD as a way of holding cash? We believe the answer is no. We hold this view for five reasons.

First, CDs generally pay sub optimal returns.

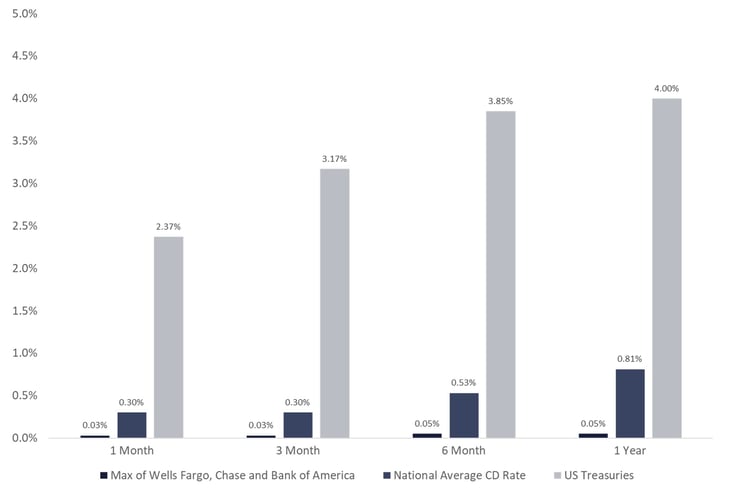

CD Rates vs. US Treasuries

As the chart above shows, significantly better yields can be found simply by investing in US Treasuries with a similar duration as the CD. Furthermore, Treasury rates will almost always be higher than bank CD rates since deposits that come into banks in the form of CDs are generally invested in a matching Treasury (a Treasury that matures close to the same date as the CD) and the bank earns the spread (the difference in yield between the Treasury and the CD).

Second, CDs may have default risk. CDs, like all deposit accounts, are only insured by the FDIC up to the $250,000 legal limit per account. So, if the bank at which you have your CD defaults, you become an unsecured creditor for any amounts over and above the $250,000 legal limit. There are ways to get around this risk but doing so can be time consuming, complicated and carry their own risks.

Third, most CDs have an early withdraw penalty. Typically, for a bank CD with a twelve month or shorter term, the penalty is three months interest, regardless of when you redeem the account prior to maturity. While this is not significant for a CD that does not pay a meaningful yield, the penalty becomes significant if the rate gets anywhere close to Treasuries, meaning that your capital is effectively tied up until maturity.

Fourth, issuers of CDs typically do not assume any fiduciary obligation on your behalf. This means that the bank doesn't assume any responsibility beyond reasonable care. Said another way, they do not have a duty to educate you on alternatives and their relative merit.

Fifth, switching costs. Occasionally the stars align, and you will find a well-capitalized bank that is offering a CD at a really attractive rate. The problem with these types of opportunities is that they are, by their very nature fleeting, and you will constantly be switching from one bank to another chasing the best opportunity. The investment of time to open new accounts is significant, not to mention the friction costs of moving money between accounts.

RCMs Government Back Liquidity Management Strategy

So, if you want to hold cash where should you place it? We believe that in the overwhelming number of cases, the best strategy for holding cash in the current environment is in short duration US Treasuries. This strategy offers the following key benefits:

- Preservation of principal. The only way you lose money from credit exposure is if the US government defaults on its obligations.

- Liquidity. The market for US Treasuries is arguably the most liquid in the world.

- Higher returns. Treasuries will provide a higher yield than CDs the vast majority of the time.

- Customizable. You can match your cash needs with the maturity of Treasuries.

- Potential to earn incremental returns. An upwardly sloping yield curve combined with active management provides RCM with opportunities to generate returns for you that are higher than the yields in the Treasury market.

- No switching costs. You don’t have to move your money to receive the highest rate.

- Potential for a fiduciary partner. Unlike a bank, RCM has a fiduciary obligation to you.

RCM has the infrastructure in place to design, create, monitor and optimize Treasury portfolios in separately managed accounts as a fiduciary to you the account holder. If you are interested in learning more, please reach out to us. For a copy of our latest fact sheet on this product, please click here.

Please reach out to us if are interested in learning more and thank you for trusting RCM with your capital. It is a privilege for us to serve you.David and Mike

Notes and Disclaimers

Annualized Yield of Liquidity Products

- Data as of 9/22/2022

- National average CD Rate data source: https://www.depositaccounts.com/cd/

- Wells Fargo, Chase and Bank of America CD Rates came from their websites

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Yields may not be indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target yields will be achieved, or objectives will be met are implied. Future returns may differ significantly from indicative yields due to many different factors. Investments involve risk and the possibility of loss of principal.

While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the values, calculations or assumptions and encourages each prospective investor to conduct their own review of the values, calculations and assumptions.

- February 01, 2026 (2)

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)