September 2021 - The Benefit of Optionality

September 01, 2021

Several months ago, Mike and I wrote a newsletter on what we believe are the merits of Roosevelt Capital Management’s (RCM) short duration high yield corporate bond strategy in today’s market environment. In that paper, we argued that our product avoids most of the pitfalls of the currently high-priced equity market, the dangers of inflation posed by holding cash and the interest rate risk associated with holding a broad index of fixed income securities. In this month’s paper, we want to revisit those same themes but cover a different benefit. This benefit is “optionality” which is too rarely talked about in the context of comparing different investments.

Equities: It’s Time Horizon that Matters

In our April 2021 article, we mentioned the fact that the Shiller PE was 37.50 and had only been higher than that on one occasion in the last 130 years - just before the burst of the dot com bubble. Five months later, the Shiller PE is even higher than it was in April and is currently sitting at 38.29. Does that mean we were wrong in our concerns expressed back in April and that one should avoid investing in equities? That depends on your time horizon.

If one does not need their funds over a significant time horizon, a strong argument can be made that you should put your money in equities and essentially forget about it. We agree with this approach. Over many years, equities will almost certainly beat fixed income. The challenge, of course, is what to do if you do not have that long time horizon or at least some portion of your portfolio does not. In that case, equities can feel risky especially in today’s environment.

For example, if you invested in the Dow at the peak of the market in 1966, the index did not return to that same level for over 14 years. That is a long time to wait to simply get back to the value of your original investment. Equities are almost certainly a good long-term investment but do not provide much in the way of options for the investor in any kind of declining market.

Cash: It’s not 1980 but inflation is real

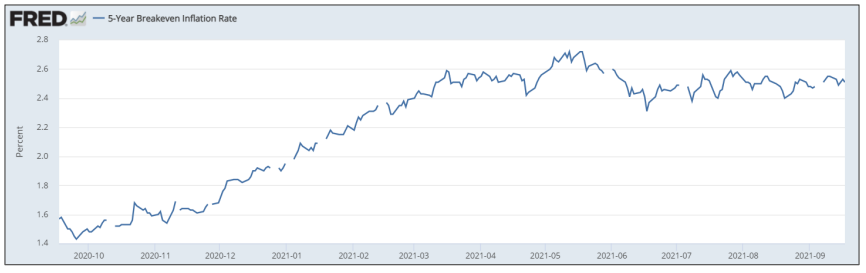

The 5-Year breakeven inflation rate (see May 2021 paper for more details) currently stands at 2.53%. It has been in that general range for several months now. For the sake of argument, let’s assume that number is an accurate reflection of what inflation will be over the next 5 years.

Unlike an automobile, the miracle of compounding works as efficiently in reverse as it does in drive. This means that every $100 you have sitting in cash today will be worth $97.47 in a year and, more dramatically, just $87.97 in five years. Sitting on cash for an extended period, even in times of historically modest inflation we are experiencing right now, leads to some pretty eye-popping “losses” over time. While holding cash may theoretically provide an investor with options to invest elsewhere, it is a very punitive strategy, by almost any measure, when implemented for any length of time.

Fixed Income Investing

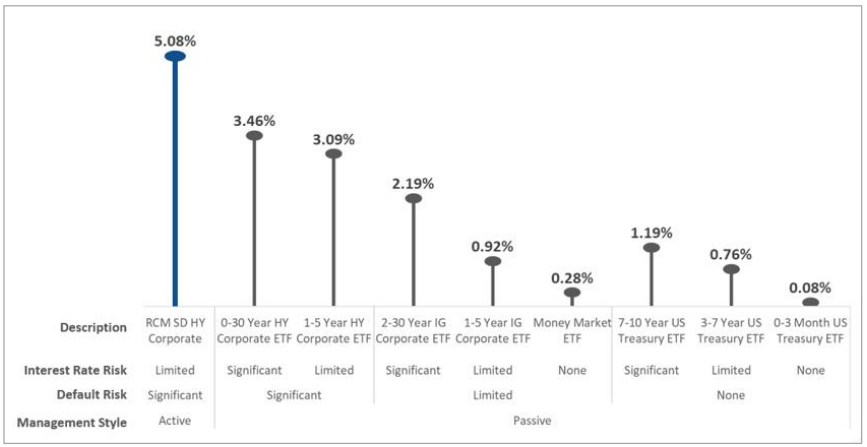

We show the chart below to all our prospective clients. It demonstrates, hopefully in a very clear and simple way, the yield our strategy is currently producing versus other fixed-income products.

Date:8/31/2021

Date:8/31/2021

What is not shown in the chart, however, is the optionality provided to our clients of holding relatively short duration bonds in a separately managed account (SMA). While one could certainly purchase US Treasuries in an SMA, the yields are well below the expected inflation rate and, particularly for the longer dated bonds, the risk of loss of capital due to interest rate increases is very real in today’s environment. ETFs and mutual funds, on the other hand, while they provide better yields, lump your investment in with everyone else. This opens you up to a potentially permanent loss of capital simply because others invested in the same fund decided to sell at an inopportune time.

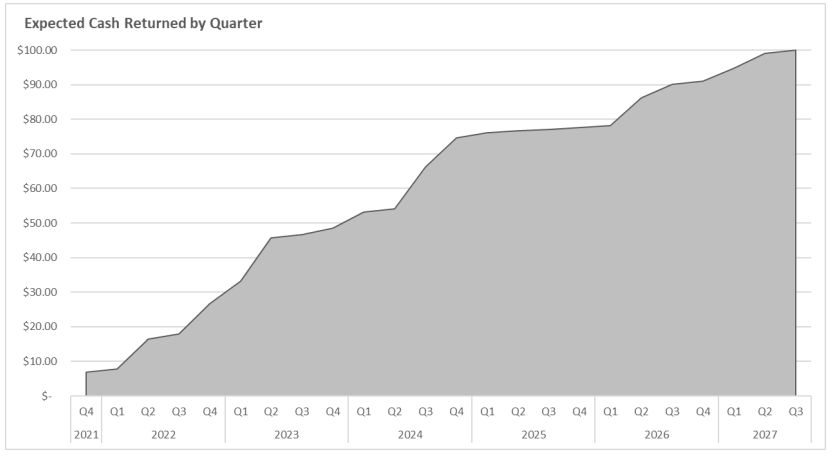

We expect that a seasoned bond portfolio managed by RCM will return the investor between 20% to 40% of the total principal of the portfolio in any given year. This creates fantastic optionality for everyone from the retired schoolteacher to a large corporation. Shown below is the cash that is expected to be returned per $100 invested for one of our recent investors.

This relatively consistent cash flow stream being returned to the investor provides great optionality. The investor may choose to simply reinvest with RCM or may alternatively withdraw the cash if other needs or investment opportunities arise. Critically, they can often meet this second set of objectives without being forced to sell to meet those requirements.

Conclusion

Mike and I spend a lot of time talking to our clients about getting their cash to work. However, almost as

importantly, we like this strategy both for ourselves and our clients because we believe it couples a meaningful return with routine optionality as bonds naturally mature, are called or cash is distributed in the form of coupon payments.

Please reach out to us with questions and comments. Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

The performance and characteristics information contained herein is for accounts solely managed by David Roosevelt, Managing Member of Roosevelt Capital Management LLC. Investment performance and characteristics through September 2019 are for Roosevelt Investments accounts managed by David Roosevelt. Investment performance and characteristics for October 2019 and thereafter are for Roosevelt Capital Management accounts managed by David Roosevelt. The performance information has been certified by ACA Compliance through December 31, 2018 and is available upon request. The values and performance information contained herein do not reflect management fees. While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the reports, values, calculations or assumptions and encourages each prospective investor to conduct their own review of the reports, values, calculations and assumptions.

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)