October 2023 - US Equities vs. Developed Country Equities

October 24, 2023

Dear Investors and Friends,

A few months ago, Mike and I wrote about equities and the long-term where we emphasized the upside potential of equities versus bonds and the implications of time horizon on our approach to asset allocation. In this month’s letter, we return to the topic of equities by doing a deep dive into what historical data says about the performance of US equities vs. developed country equities and the implication on RCM’s approach to equity asset allocation.

Key Takeaways from July 2023 Letter

As mentioned above, our July 2023 letter covered this topic looking primarily at the outperformance of equities over bonds given various time horizons since 1871. They key takeaways from that letter were:

- Over a horizon of 35 years, equities outperform bonds 100.0% of the time,

- Over a horizon of 10 years, equities outperform bonds 85.7% of the time, and

- Over the horizons evaluated, the annual average outperformance of equities vs. bonds ranges from 4.1% to 6.6%.

The Historical Performance of US Equities vs. Developed Country Equities

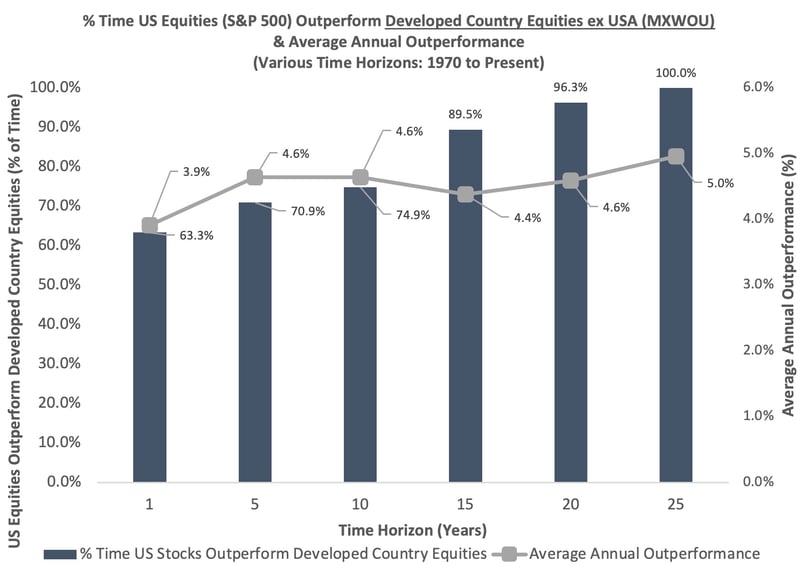

The chart below is a comparison of US equities, as represented by the S&P 500 (Bloomberg ticker: SPXT Index), to developed country equities, as represented by the MSCI World ex USA Index (Bloomberg ticker: MXWOU Index), since 1970. It shows two things:

- The blue bars highlight the frequency with which US equities outperformed developed country equities over various time horizons, and

- The grey markers / line indicate the average annual outperformance of US equities over developed country equities over those time horizons.

The chart is quite astounding. To illustrate what it is saying, given a horizon of 25 years, SPXT outperformed MXWOU 100% of the time with an average annual outperformance of 5.0%. Wow!

An Explanation for the Outperformance and a View on its Continuance

A detailed explanation for this outperformance is beyond the scope of this letter but we believe a few of the qualitative explanatory variables include the relative stability, transparency, predictability, rule of law, property rights, system of taxation, culture of entrepreneurship and innovation, size, financial strength, and access to capital of the United States vs. the other developed countries.

Will the outperformance continue? We certainly do not have a crystal ball and we, like many, are concerned about the decline in our country’s financial strength as represented by the increase in debt to GDP, as well as the internal division and strong polarization amongst the people of our country. Although, a decline in financial strength and an increase in divisiveness are currently plaguing much of the developed world, so while the US has declined, so have others.

We read many who say that America’s best days are over. We respectfully but fervently disagree. To quote Warren Buffett from his last annual letter, “America's dynamism has made a huge contribution to whatever success Berkshire has achieved -- a contribution Berkshire will always need. We count on the American Tailwind and, though it has been becalmed from time to time, its propelling force has always returned. I have been investing for 80 years -- more than one-third of our country's lifetime. Despite our citizens' penchant -- almost enthusiasm -- for self-criticism and self-doubt, I have yet to see a time when it made sense to make a long-term bet against America. And I doubt very much that any reader of this letter will have a different experience in the future.”

RCM Approach

As stated in earlier letters, at our firm, we break down your capital into distinct "buckets" based on various constraints or objectives. Each bucket is thoughtfully allocated to asset classes that align with its unique goals. Long term capital is placed in equities, medium term capital is invested in bonds and short-term capital is allocated to short duration Treasuries.

Given the historical data above combined with our view that America ultimately rises to overcome its challenges, in our clients’ equity buckets we have a strong bias towards allocating capital to US domiciled equities.

Please reach out to us with questions and comments. Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the values, calculations or assumptions and encourages each prospective investor to conduct their own review of the audits, values, calculations and assumptions.

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)