October 2021 - Q3 2021 Update

October 01, 2021

The purpose of this month’s letter is to provide an overview of Roosevelt Capital Management’s (“RCM”) Q3 performance. In addition, we also hope to provide some context on why we believe the popular opinion that “bonds are a bad investment right now” can coexist alongside our ongoing advice that a Roosevelt Capital Management bond portfolio is an attractive investment for those wishing to generate yield and maintain optionality with their capital.

Performance Overview

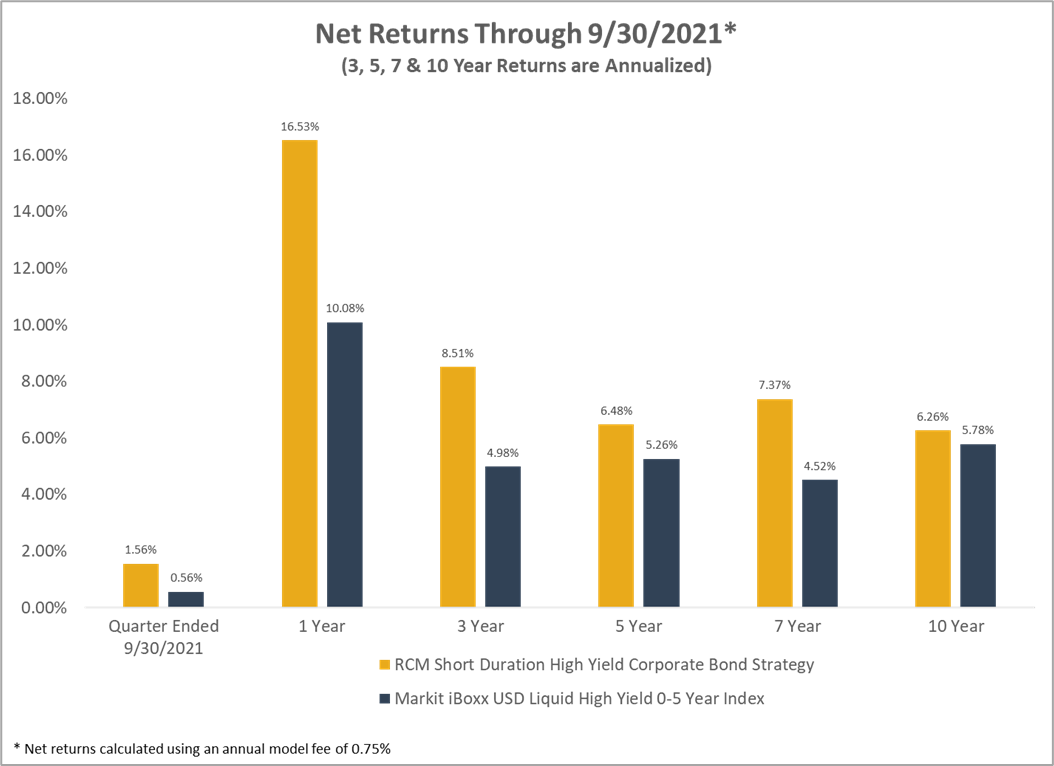

The chart below provides an overview of RCM’s performance against our benchmark (Markit iBoxx USD Liquid High Yield 0 – 5 Year Index). We continue to outperform the index in both the recent quarter ended and over the long-term. While there will almost certainly be periods where we underperform, we continue to be confident that over time we will outperform the index due to our proprietary and repeatable processes embedded in custom technology that we continuously improve.

“Bonds Are a Bad Investment”

While this quarterly letter is primarily intended to provide current and potential clients with a performance summary, we do want to take a moment to address the prevailing thought that “bonds are a bad investment.” To be clear, we agree wholeheartedly that an investor should not be in the broader bond market.

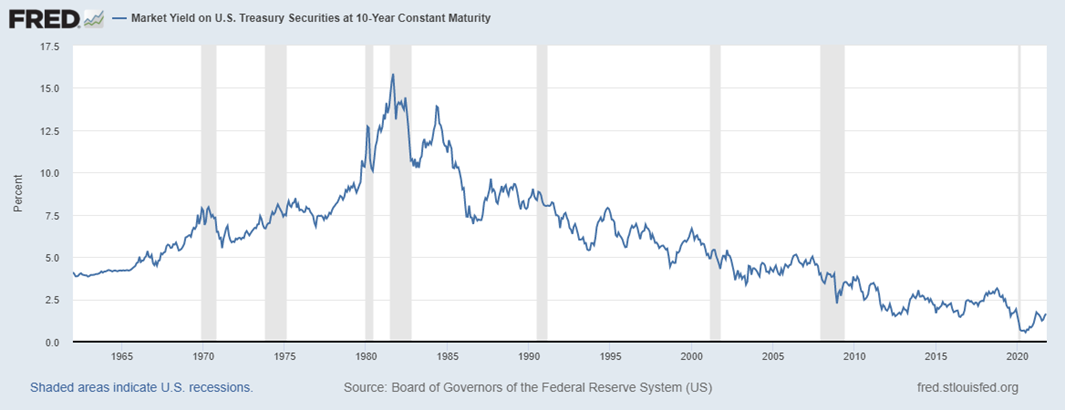

Why do we feel this way? There are several reasons, but they nearly all come back in one way or another to interest rates and interest rate risk. Interest rates in the United States, as the chart below shows, recently hit all-time lows. Even the recent uptick pales in comparison to long-term averages.

Bond math can be, to put it lightly, a bit esoteric. So, for those of you that do not spend your days thinking about these kinds of things, what follows is a quick and specific example on why investing at these historically low rates is almost certainly a bad idea.

The most widely used index for the performance of US bonds in the United States is the Bloomberg Barclays US Aggregate Bond Index (“the Agg”). This index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market and includes Treasuries, Agencies, corporate bonds, MBS, ABS and CMBS. Buyers of this index today should expect:

- Yield of approximately 1.7%

- Duration of 6.8 years.[1]

- In the event of a 1% increase in interest rates, which does not get rates anywhere near their long-term averages, it will take an investor in the Agg approximately 4 years to reach breakeven.

Investors in the broader bond market today are not being compensated for taking interest rate risk.

RCM Bond Portfolio

With an example like that, why do we still deploy our own and our clients’ capital in bonds? As we mentioned at the beginning of the letter, just because “bonds are bad” does not mean “all bonds are bond.”

RCM has a singular focus. We buy specific securities in the short duration, high yield, corporate bond market. This is very different than investing in the broader bond market through an SMA, ETF or mutual fund[1].

Let’s scrutinize RCM’s portfolio the same way we did the Agg in the example above. The “average” RCM investor can expect:

- Yield of approximately 5.4%

- Duration of 2.7 years

- In the event of a 1% increase in interest rates it will take an RCM investor approximately 6 months to reach breakeven.

RCM investors will recoup their losses 3 ½ years sooner than investors in the broader bond market under these assumptions.

Conclusion

While we would not advocate a broad-based diversified bond portfolio in today’s environment, we continue to believe in the advantages of investing in specific bonds that fit our criteria.

[1] Duration is a measure of an investment’s sensitivity to interest rate fluctuations, for a detailed discussion of duration see our March 2021 Newsletter.

[2] For a detailed discussion on our strategy, see our April 2021 Newsletter.

Please reach out to us with questions and comments. Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

The performance and characteristics information contained herein is for accounts solely managed by David Roosevelt, Managing Member of Roosevelt Capital Management LLC. Investment performance and characteristics through September 2019 are for Roosevelt Investments accounts managed by David Roosevelt. Investment performance and characteristics for October 2019 and thereafter are for Roosevelt Capital Management accounts managed by David Roosevelt. The performance information has been certified by ACA Compliance through December 31, 2018 and is available upon request. The values and performance information contained herein do not reflect management fees. While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the reports, values, calculations or assumptions and encourages each prospective investor to conduct their own review of the reports, values, calculations and assumptions.

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)