November 2021 - The Benefits of SMAs

November 01, 2021

So, are pooled investments a bad idea? No. There are many situations where these types of investments make sense. Mike and I both own mutual funds and, at some point, we might create a fund ourselves to make what we do more accessible to investors that simply do not have the capital to own a portfolio of individual bonds. However, we also believe that if one has the financial wherewithal to own individual securities, lacks the time and/or expertise to create and manage the portfolio themselves and has the right asset manager’s expertise available to them, a Separately Managed Account (SMA) is an excellent choice for investing one’s capital because ultimate control remains with the capital owner.

The purpose of this month’s letter is to provide a brief overview of the thinking that went into our decision to manage client money in SMAs for our clients’ short duration high yield corporate debt portfolios.

What is a Separately Managed Account?

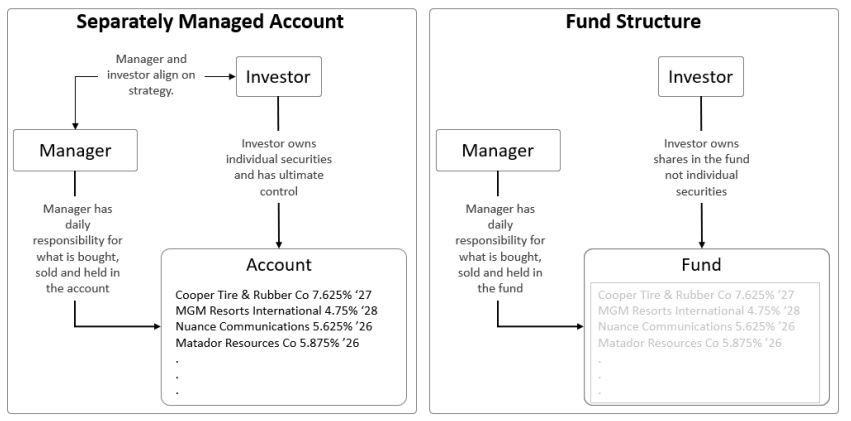

For anyone not familiar with the term, an SMA is simply an account where the account holder owns individual securities, such as stocks or bonds, and the management of the account is outsourced to a professional asset management firm. This contrasts with investments in products like mutual funds or ETFs where the investor does not actually own the individual securities in the fund but rather a portion or share of the fund that owns the securities.

What are the benefits and risks of a mutual or ETF fund structure

There are many benefits to a fund. (Note: For purposes of this letter, when we reference a “fund” we are

specifically talking about mutual funds and ETFS. There are obviously other types of pooled investment vehicles such as limited partnerships. These structures will be the subject of a future letter). A fund structure provides relatively easy access to a basket of securities offering the possibility of more-or-less instantaneous diversification.

A fund provides the investor with a particular investment manager’s expertise; expertise that may not otherwise be available. And funds can be quite liquid even in times of volatility. However, there are several drawbacks to funds that are often ignored. These include:

- Lack of control

- No influence over the investment strategy

- No direct communication with the manager

- Potential for misalignment of incentives between manager and investors

- Potential for misalignment of incentives between the investor and other investors

- Potential lack of transparency into the manager’s decision-making process

- Potential for negative impacts by actions of other investors particularly in times of volatility

- Potential for adverse tax impacts

- Poor transfer of “learning” from the manager to the investor

- Inability to leave the manager without also leaving the fund

What are the benefits and risks of an SMA?

In nearly every negative case above, the SMA structure solves the problem posed by a fund. So, why are SMAs not nearly as ubiquitous as mutual funds and ETFs. There are a couple primary reasons:

- Capital outlay required

- Ease of investment / ease of exit

For an SMA to make sense economically for both the investor and the manager, the minimum investment is sometimes financially out-of-reach of the investor. While improvements in technology and process continue to bring these minimums down, they are not now, nor will they likely ever have the same low investment threshold as buying into a fund.

An SMA requires more paperwork than a fund. In an SMA the investor must establish a dedicated brokerage account, along with ancillary documentation, and enter into an Investment Management Agreement with the Manager. Buying or selling a fund is generally no different than buying or selling a stock, albeit we are ignoring the minor complexities associated with buying or selling an open-ended mutual fund that takes place at the end of the day at the fund’s net asset value.

The RCM Perspective

Regarding the two differences above, Mike and I continuously work on the first item although we understand that owning individual bonds in an SMA will simply be out of reach for some investors which is why we may someday start a fund ourselves despite the downsides discussed above.

Regarding ease of investment, Mike and I have made the process of setting up an SMA as “turn-key” as possible. Regarding ease of exit, we had an investor that, for personal reasons, needed to exit his entire portfolio, which we were able to do the same day. To be fair though, the liquidity of shares in a fund will almost always be higher than the liquidity of the underlying securities owned by the fund.

Investing in a fund or an asset management firm like Roosevelt Capital Management in an SMA is fundamentally an exercise in trust. At RCM we try to earn our investors’ trust in several ways:

- Long term independently verified track record

- Access to either one of us at any time

- The ability to fire us with seven days’ notice as a way to hold us accountable

- Individualized and daily account-level performance detail

Please reach out to us with questions and comments. Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

The performance and characteristics information contained herein is for accounts solely managed by David Roosevelt, Managing Member of Roosevelt Capital Management LLC. Investment performance and characteristics through September 2019 are for Roosevelt Investments accounts managed by David Roosevelt. Investment performance and characteristics for October 2019 and thereafter are for Roosevelt Capital Management accounts managed by David Roosevelt. The performance information has been certified by ACA Compliance through December 31, 2018 and is available upon request. The values and performance information contained herein do not reflect management fees. While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the reports, values, calculations or assumptions and encourages each prospective investor to conduct their own review of the reports, values, calculations and assumptions.

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)