March 2024 - Navigating Market Timing and Fear-Driven Selling

March 26, 2024

Dear Investors and Friends,

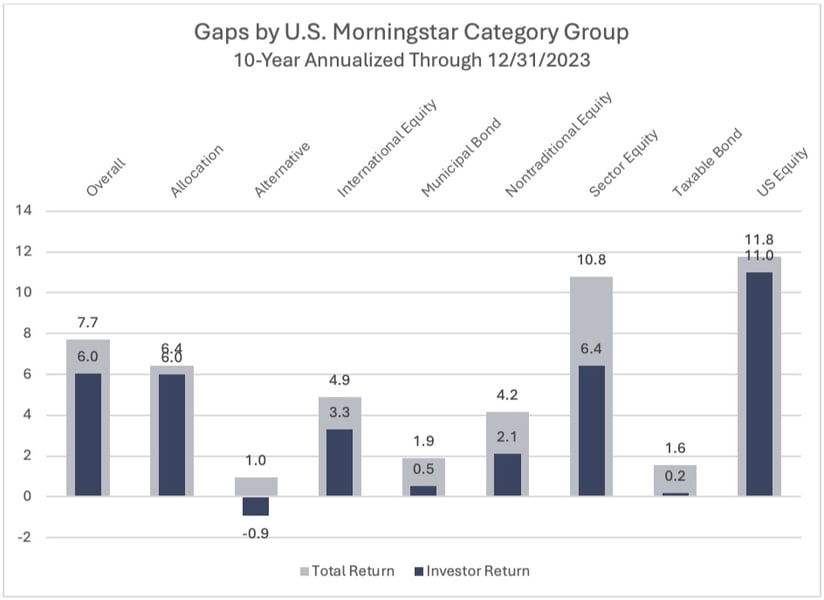

In the complex world of investing, one of the most prevalent and costly errors individuals make is succumbing to the allure of market timing and allowing fear to steer their decisions. A recent Morningstar report (the full report can be found by clicking here) sheds light on this critical issue, revealing the stark reality that misguided market timing and fear-driven selling can significantly diminish investor returns over time.

The Gap Between Total Return and Investor Return by Category

Morningstar's annual study of dollar-weighted returns reveals a sobering truth: over the past decade, overall investors earned an average annual return of 6.0% on their fund investments, significantly lower than the 7.7% annual total returns generated by those funds. This 1.7-percentage-point shortfall, or gap, is primarily attributed to poorly timed purchases and sales of fund shares, costing investors approximately one fifth of the return they could have earned by simply adopting a buy-and-hold strategy.

This gap between investor returns and total returns has remained consistent over multiple 10-year periods, indicating persistent deleterious investor behavior. The report underscores the significant impact of cash flow timing on investor outcomes, emphasizing that this factor, alongside investment costs and tax efficiency (which we will discuss in subsequent letters), plays a pivotal role in determining an investor's ultimate results.

Improving Investor Performance: Key Takeaways

So, what can investors glean from this study to enhance their investment approach? Here are some key takeaways:

- Emphasize simplicity and diversification: Morningstar's research suggests that holding fewer, widely diversified funds can help investors capture more of their investments total returns. By avoiding narrow or highly volatile funds and favoring simpler, more straightforward investment strategies, investors can mitigate the risk of costly mistakes.

- Beware of market timing pitfalls: Attempting to time the market or engage in frequent trading can erode investment returns over time. Morningstar's findings indicate that investors tend to struggle with market timing, often buying high and selling low. Instead, adopting a disciplined, long-term investment approach and resisting the urge to react impulsively to market fluctuations can lead to better outcomes.

Conclusion

Our job at RCM is to guide our clients through market uncertainties and help them navigate the complexities of investing. The Morningstar report serves as a poignant reminder of the pitfalls associated with market timing and fear-driven selling. By learning from these insights and adhering to a disciplined, long-term investment approach, investors improve their chances of achieving their objectives.

Please reach out to us with questions and comments. Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

1 Wall Street Journal. “Investors Are Hungry for Risk—and Holding Record Cash Sums”, November 23, 2023 and Bank Policy Institute, “What to do About Uninsured Deposits?”, October 5, 2023.

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the values, calculations or assumptions and encourages each prospective investor to conduct their own review of the audits, values, calculations and assumptions.

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)