March 2022 - Nowhere to Hide

March 29, 2022

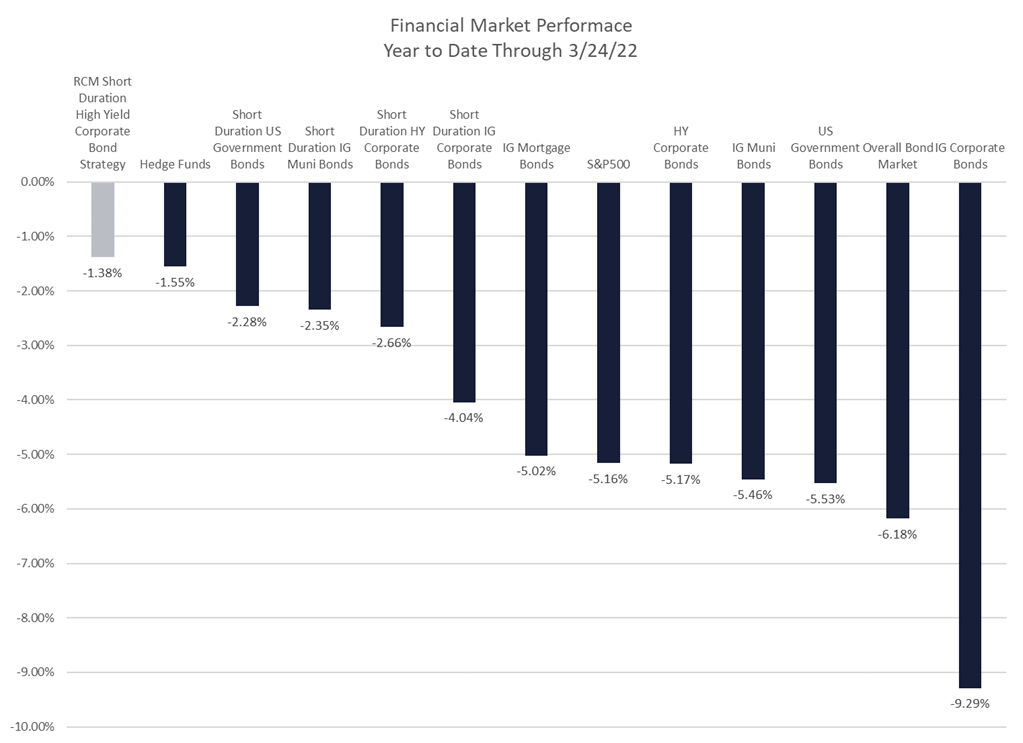

Year to date financial market performance reminds us of one of our favorite songs Nowhere to Run by Martha Reeves & The Vandellas. As the chart below illustrates, unless you were short the market (or long commodities), you are down.

Why Has Everything Sold Off?

The financial market is a big “machine.” A simplistic but robust description of the variables impacting the “machine” today are as follows.

As the diagram above shows, market prices are largely a function of the net present value of expected future cash flows. Net present values are largely a function of discount rates. Discount rates are largely a function of interest rates. And interest rates are largely a function of inflation.

Going a step further because inflation has risen significantly, interest rates have risen significantly. Because interest rates have risen significantly, discount rates have risen significantly. Because discount rates have risen significantly, net present values have fallen significantly. Because net present values have fallen significantly, market prices have fallen significantly.

A Decomposition of RCM’s YTD Performance

As the performance chart at the top of the letter shows, RCM’s YTD performance leads the market. While our short duration high yield strategy is not immune from inflation, given important characteristics of how we operate, inflation’s impact tends to be muted and short lived. How so? There are 3 main drivers:

- Short duration. Duration measures the sensitivity of price to interest rate changes. As we have said in past letters, we operate a short duration portfolio because the market has not been compensating investors for interest rate risk.

- High yield. The higher the yield, all things equal, the greater the hedge an instrument has against inflation. While higher yield also tends to come with increased default risk, it is this risk that RCM specializes in managing.

- Portfolio optimization. Volatility, all else equal, is not risk, it is opportunity. RCM is constantly looking for opportunities to optimize the return on portfolios by selling lower yielding bonds to buy higher yielding bonds.

How Has Ukraine Impacted the US Bond Market

The day after we sent our February letter, February 24th, Russia invaded Ukraine. We would be remiss if we did not address how the invasion has impacted bonds.

- Initial flight to safety and lower yields. Whenever there is a major destabilizing event that creates uncertainty and fear, there tends to be an immediate appetite for safe assets relative to risky assets. Because US Treasury bonds are seen as one of the safest places to deploy capital, demand for them significantly increased driving yields lower in the week after the attack.

- Initial flight to safety and wider spreads. Spreads are the difference in yield between Treasuries and other bonds. As Treasury prices increased with demand, the demand for corporate bonds, both investment grade and high yield, waned. The result for corporate bonds was lower prices, higher yields, and wider spreads.

- Subsequent realization by the market that wars tend to be inflationary and this one is no exception. 12% of the world’s oil and 45% of the European Union’s natural gas come from Russia. As our readers are no doubt aware, the world is in the midst of an energy crisis and the Ukrainian conflict exacerbates it; as energy prices rise, prices of other goods and services inevitably follow. After the initial flight to safety, as the market came to the realization that the war in Ukraine will likely serve to make a newly hawkish Fed even more aggressive, Treasury yields have literally screamed higher, lowering prices across the fixed income complex.

Where Do We Go from Here?

Let’s first start with a very important premise – there is no such thing as “sitting on the sidelines.” Every dollar at an investor’s disposal has an investment decision tied to it; bank accounts, CDs and money markets are simply investments in cash & equivalents. Having stated that foundational truth, this is admittedly an exceptionally difficult time to invest. Why? In today’s environment, if you remain in cash, you will get killed by inflation. Higher interest rates increase the discount rate, lowering the price of equities. Higher interest rates also destroy the prices of longer dated bonds. And there is no yield in investment grade shorter duration bonds.

We have no crystal ball on where rates will go from here, but we are incredibly encouraged by the performance of short duration high yield corporate bonds relative to other financial assets considering the huge increase in rates we have seen. Furthermore, bond math tells us that, barring a default, we will get the yield at which we deploy capital, it’s simply a matter of time. And lastly, because a short duration bond portfolio is regularly throwing off cash through redemptions, the higher yields that inflation generates mean higher future returns to us and our investors. For these reasons, we continue to place our capital and that of our investors in short duration high yield corporate bonds.

Please reach out to us with questions and comments. Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

The performance and characteristics information contained herein is for accounts solely managed by David Roosevelt, Managing Member of Roosevelt Capital Management LLC. Investment performance and characteristics through September 2019 are for Roosevelt Investments accounts managed by David Roosevelt. Investment performance and characteristics for October 2019 and thereafter are for Roosevelt Capital Management accounts managed by David Roosevelt. The performance information has been certified by ACA Compliance through December 31, 2018 and is available upon request. The values and performance information contained herein do not reflect management fees. While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the reports, values, calculations or assumptions and encourages each prospective investor to conduct their own review of the reports, values, calculations and assumptions.

- February 01, 2026 (2)

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)