June 2023 - The Silver-Lining in Today’s Market

June 27, 2023

Dear Investors and Friends,

There are a lot of potential downsides in the current volatile financial landscape. For investors holding cash, however, there is one significant and simple upside. We believe that the best place, by far, to park cash in the current environment is directly in short duration U.S. Treasuries. Roosevelt Capital Management (RCM) is currently deploying cash for our clients at annualized yields, net of fees, approaching and in some cases exceeding 5.0% annualized return through a Separately Managed Account where the client owns the bonds directly in their name, but all trading is done by RCM. Please feel free to reach out to us at (214) 871-2666 or by email if you are interested in learning more about how we manage client cash and can quickly and efficiently get your cash to work too.

For the reader interested in learning more about the details of why you should consider holding cash directly in US Treasuries, please read on. We believe there are three key considerations.

Point 1: Cash balances over FDIC insurance limits are much safer in US Treasuries

In the event of a crisis at your bank, uninsured deposits face the potential for substantial losses. By contrast, Treasury securities owned directly in your name and custodied at a large, well-respected custody bank offer significant advantages. While counter-party risk can never be completely eliminated, this fundamental difference becomes critically important in the event of a catastrophic event like a bankruptcy.

Point 2: You are likely being inadequately compensated for storing your money in other products.

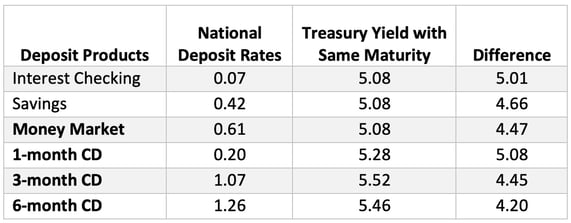

Below is data from the FDIC’s website as of June 20, 2023 showing the rate paid by various bank products and the equivalent US Treasury yield.

On top of the modest returns outlined above, there are over $8 trillion in uninsured deposits in these products. So not only are the returns lower but the risks are also higher.

Point 3: A Google search will locate great teaser rates but beware of the fine print and switching costs

Even if you manage to find a competitive rate at a bank or broker, it is often a teaser rate, available for a limited time or a limited amount of money. This presents a challenge as you may have to continually monitor and ultimately switch institutions to maintain a favorable rate. However, in the era of the Patriot Act and stringent regulations, opening a new account incurs significant switching costs and administrative hassle. These indirect costs must be carefully considered as they impact your overall return on investment.

The Appeal of Short Duration US Treasuries

Considering the risks and limitations associated with banks, it is essential to identify a superior alternative for storing your money. Short duration US Treasuries emerge as a compelling solution for several reasons.

- US Treasuries are widely recognized as the safest securities in the world. Backed by the full faith and credit of the United States government, they offer unparalleled security for depositors.

- Short duration US Treasuries provide better returns than what banks can typically offer. This potential for enhanced returns makes them an attractive option for depositors seeking to optimize their financial position.

- Short duration US Treasuries boast exceptional liquidity. Unlike other investment options, they offer the advantage of being easily sold, with the proceeds available on the same day. This high level of liquidity ensures that depositors have quick access to their funds whenever needed, providing flexibility and peace of mind.

- Often overlooked until it becomes necessary, owning short duration US Treasuries directly eliminates the need for switching between institutions to chase the best currently available product.

Roosevelt Capital Management - Simplifying Cash Management

At Roosevelt Capital Management, we specialize in cash management and fixed income investing. By entrusting us with your cash, you can alleviate the burden of managing your funds independently. Our expertise allows us to minimize risk while maximizing your return potential.

As specialists in short duration US Treasuries, we offer a comprehensive solution that aligns with the aforementioned benefits. By investing your cash in short duration US Treasuries, we provide a secure and lucrative alternative to traditional banking. Our focus on risk management ensures that your capital is protected while taking advantage of higher returns. Additionally, our dedicated team is readily available to address your needs, making the process efficient and convenient. Simply reach out to us, and we will assist you promptly.

Make an informed decision about where to store your money and take advantage of the benefits offered by short duration US Treasuries. Allow Roosevelt Capital Management to be your trusted partner in managing your cash effectively.

Please reach out to us with questions and comments. Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the values, calculations or assumptions and encourages each prospective investor to conduct their own review of the audits, values, calculations and assumptions.

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)