July 2023 - Equities & The Long-Term

July 26, 2023

Dear Investors and Friends,

Several months ago, Mike and I wrote a letter on the importance of time horizon when making asset allocation decisions. While we made note of the well-established fact that equities outperform bonds over the long term, most of that letter was focused on managing downside risk – drawdown and years to recovery. In this month’s letter, we return to the topic of time horizon but with an emphasis on the upside potential of equities versus bonds and the implications of time horizon on our approach to asset allocation.

Key Takeaways from December 2022 Letter

As mentioned above, our December 2022 letter covered this topic looking primarily at downside risks. Here are the key takeaways from that letter:

- Over the last 35 years, the worst years-to-recovery an equity investor would have experienced in the S&P 500 was 6.13 years.

- Over the last 35 years, the worst drawdown an equity investor would have experienced investing in the S&P 500 was 55.25%.

- In both cases, while a bond investor would not have been immune from declines, the magnitude and longevity of those declines was much less severe.

The Benefits of Equities over the Long Term

Of course, metrics like drawdown and years to recover are only one side of the equation. What about performance over the short, medium, and long term? Unsurprisingly, in the case of returns, one sees the benefit of investing in equities the longer the time horizon.

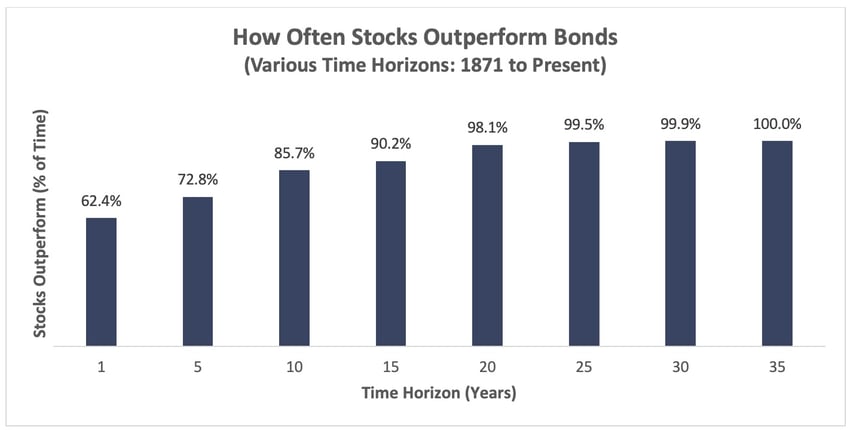

The chart below shows the frequency with which stocks outperform bonds over various time horizons. On average, the annual outperformance ranges from 4.1% to 6.6%.

The implications of this analysis are substantial and worth noting:

- Investment horizon exceeds 10 years: Equities are overwhelmingly likely to be the better option but be prepared for a potentially bumpy ride. In some cases, a very bumpy ride!

- Investment horizon is less than 5 years: RCM’s perspective is that bonds are a better option for two reasons:

- A little over one in every four years, on average, equities have underperformed bonds and if you need capital during that time, that underperformance could be significant, and

- A well-tailored and thoughtfully constructed bond portfolio can still offer meaningful returns along with the peace of mind that comes with knowing liquidity is there if needed.

- Investment horizon between 5 and 10 years: The strategy for investor funds with a time horizon of 5 to 10 years is much more investor and objective specific than the first two “buckets” since there is a high degree of likelihood equities will outperform but still a meaningful chance they will not.

RCM Approach

At our firm, we break down your capital into distinct "buckets" based on various constraints or objectives. Each bucket is thoughtfully allocated to asset classes that align with its unique goals. Long term capital is placed in equities, medium term capital is invested in bonds and short-term capital is allocated to short duration Treasuries. By tailoring your investment approach to suit the specific needs of each bucket, we strive to optimize your risk-adjusted returns and align with your financial objectives.

As always, our team is here to answer any questions you may have and provide personalized advice tailored to your unique financial situation. We appreciate your trust in us as your financial partner and look forward to continuing this journey together.

Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the values, calculations or assumptions and encourages each prospective investor to conduct their own review of the audits, values, calculations and assumptions.

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)