July 2021 - First Half 2021 Update

July 01, 2021

We started writing these monthly letters with two objectives. First, we wanted to create a forum for providing regular updates on our own approach to investing in fixed income securities in order to better educate current and potential clients on how and why we are making the investments we are making. Second, we wanted to provide periodic performance summaries and cover any macro-economic trends that are influencing that performance.

This letter is focused on that second objective. The purpose of this month’s letter is to provide an update on Roosevelt Capital Management’s (“RCM”) recent performance and then dig into the somewhat arcane world of credit spreads because even a rudimentary understanding of the topic will shed a lot of light on our near-term performance.

Performance Overview

In the first half of 2021:

- RCM’s annualized gross return was 17.27% versus 8.42% for the benchmark

- RCM’s nominal gross return was 8.29% versus 4.12% the benchmark[1]

We firmly believe that RCM’s long-term outperformance of the index is attributable to proprietary and repeatable processes embedded in custom technology that we continuously monitor and improve. However, it would be imprudent of us to make the same claims about very recent performance and feel compelled to communicate this perspective to both current and potential clients. Bond spread compression is a major factor, if not the major factor, in our recent numbers. It is worth understanding exactly what that means and why it matters.

High Yield Corporate Bond Spreads

Credit spreads are simply the difference in yield between a corporate bond and a US Treasury of a similar maturity. Assuming the US Treasury yield is constant, a tighter spread indicates a higher bond price, and a wider spread indicates a lower bond price. Said another way, high credit spreads reflect low bond valuations and low credit spreads reflect high valuations.

If one views the default risk of a US Treasury to be zero, then the spread of a corporate bond over and above a comparable Treasury is meant to compensate the investor for the default risk he or she is taking. For instance, 5-year Treasuries currently trade at a yield of approximately 0.80% while the SM Energy 2026 corporate bond is trading at approximately 6.0% yield. The spread between the SM Energy bond and the similarly dated US Treasury is 5.20%. The incremental 5.20% that the investor receives versus the Treasury compensates the investor for the additional default risk over and above the Treasury that the market perceives the SM Energy bond has.

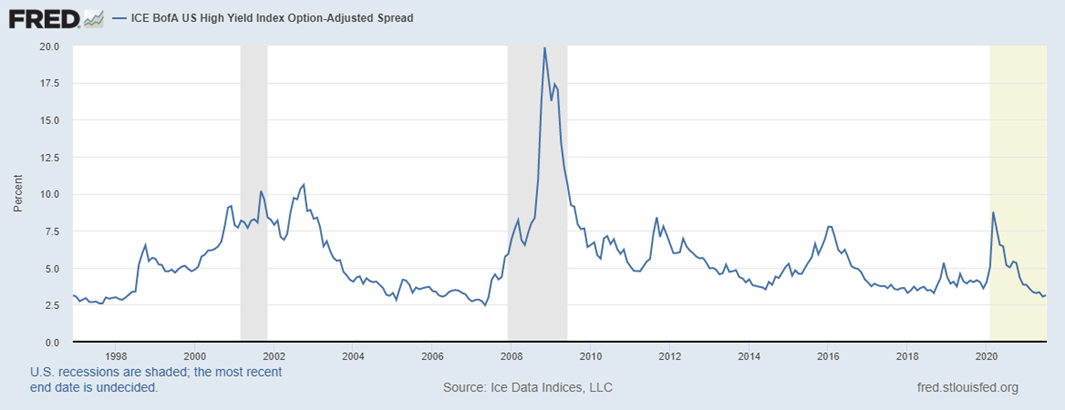

Below is a chart from the St. Louis Fed showing high yield bond spreads since December 1996.

An understanding of credit spreads allows investors to make several observations:

- Credit spreads rapidly increase in times of economic uncertainty and tighten as uncertainty abates.

- Current spreads are just above 3% which is approaching their all-time tightest range.

- When spreads do “blow out,” they can get very wide.

What Does This All Mean to RCM investors?

The global economy has come out of a period of significant uncertainty to a time of substantial, albeit unequal, economic prosperity. Credit spreads were very wide at the height of Covid but have compressed dramatically thereby boosting bond valuations. The significant compression in credit spreads helps to explain a large portion of the returns RCM has been able to generate for investors since Covid. While it may seem counterintuitive, we believe our best returns will be born from times of significant economic stress. This is when credit spreads blow out, or said another way, yields are highest, and prices are lowest. It is during these times that we can buy significantly discounted bonds with what we deem to be low actual probabilities of default.

The current low credit spreads will make it impossible to generate similar returns over the near future. The bonds that we were able to buy at major discounts because of Covid are now trading at high premiums to par. The bonds that are trading at significant discounts today are justifiably trading there because of meaningful and real default risk. For the most part we want nothing to do with those bonds.

What can RCM investors expect in the near term? Before fees and assuming we can avoid defaults, we are currently placing capital to work at yield to worsts of approximately 4%, or a credit spread of approximately 3.50%, and it is our expectation that we will be able to generate an additional 1% to 2% in annual return through active management. We have great conviction that these expected returns will meaningfully beat the index, which is currently at a yield to worst of 3.02%. What gives us confidence? An active management process geared towards continuously optimizing returns while working to eliminate default risk.

How do we feel about our expected returns? For the risk we are taking and the flexibility we are preserving, we continue to think the returns we expect to generate are excellent considering that equities are at all time high valuations, Treasuries are trading close to all-time tight low yields, investment grade bonds offer paltry returns and cash offers next to nothing.

Please reach out to us with questions and comments. Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

[1] Nominal returns are simply the return for the period in question. In this case, the first half of 2021.

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

The performance and characteristics information contained herein is for accounts solely managed by David Roosevelt, Managing Member of Roosevelt Capital Management LLC. Investment performance and characteristics through September 2019 are for Roosevelt Investments accounts managed by David Roosevelt. Investment performance and characteristics for October 2019 and thereafter are for Roosevelt Capital Management accounts managed by David Roosevelt. The performance information has been certified by ACA Compliance through December 31, 2018 and is available upon request. The values and performance information contained herein do not reflect management fees. While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the reports, values, calculations or assumptions and encourages each prospective investor to conduct their own review of the reports, values, calculations and assumptions.

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)