January 2022 - 2021 Performance Review

January 01, 2022

2021 Performance

So how did RCM do in this year of chaos? We are thankful that we successfully navigated the tumult and were able to continue to generate solid returns for our clients.

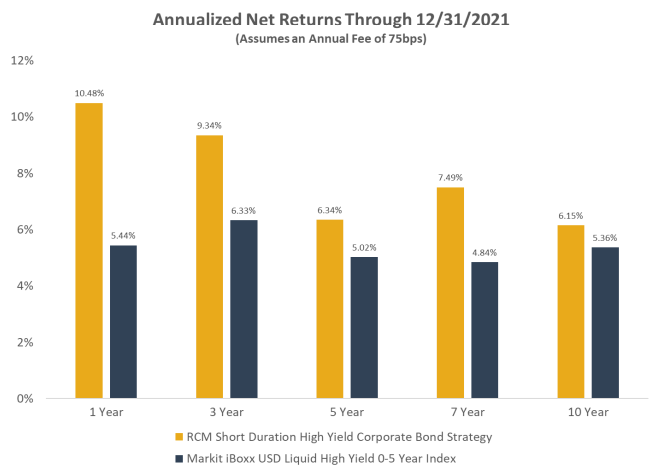

• As shown in the graph below, our Short Duration High Yield Corporate Bond Composite returned 10.48% in 2021, nearly double our benchmark, the Markit iBoxx USD Liquid High Yield 0-5 Index.

• Our outperformance vs. the bond market, in general, as measured by the Bloomberg US Aggregate Bond Index, was even better at 10.48% vs. -1.54%.

We would like to make 3 observations about our 2021 and historical performance.

First, not all bonds are bad. Over the last year the popular financial press has frequently written in one form or another that “bonds are bad” and one should not invest in them. While there are many valid reasons for these arguments, RCM’s performance and that of our benchmark indicates that there are wonderful opportunities in the bond markets, one just needs to know where to look and how to manage the risk.

Second, active management can add significant value. While passive investing is the rage these days, RCM’s outperformance is a function of timeless investing principles, repeatable processes, and cutting-edge technology. Since 2013, according to Bloomberg, passive’s share of U.S. fund assets has grown about 2.3 percentage points a year. The goal of passive investing is to simply track “a market.” RCM has a completely different goal – be the best in the bond market.

Third, we are getting better. Our outperformance of the index is getting more consistent and significant. This is the natural result of a process rooted in continuous improvement. Mike and I are constantly challenging each other’s thinking and asking what the flaws in our processes are. We welcome our investors and friends to be a part of our growth and development.

How Does RCM Expect to Do in 2022?

RCM expects to continue to meaningfully outperform the overall bond market and our benchmark. On a related note, with the near certainty that the Fed will significantly increase interest rates to combat inflationary pressures, by far the most frequent question we receive is how our strategy will perform in a rising interest rate environment. The short answer is we will generate higher returns over the medium to longer term. Our 2022 outlook and the impact of inflation will be the topic of next month’s letter.

Please reach out to us with questions and comments. Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

The performance and characteristics information contained herein is for accounts solely managed by David Roosevelt, Managing Member of Roosevelt Capital Management LLC. Investment performance and characteristics through September 2019 are for Roosevelt Investments accounts managed by David Roosevelt. Investment performance and characteristics for October 2019 and thereafter are for Roosevelt Capital Management accounts managed by David Roosevelt. The performance information has been certified by ACA Compliance through December 31, 2018 and is available upon request. The values and performance information contained herein do not reflect management fees. While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the reports, values, calculations or assumptions and encourages each prospective investor to conduct their own review of the reports, values, calculations and assumptions.

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)