January 2021 - 2020 Recap

January 01, 2021

We hope you are well and starting off the new year safe and healthy. The purpose of this letter is to recap 2020 and provide an outlook for 2021.

2020 Recap

Highlights for the prior year include the following:

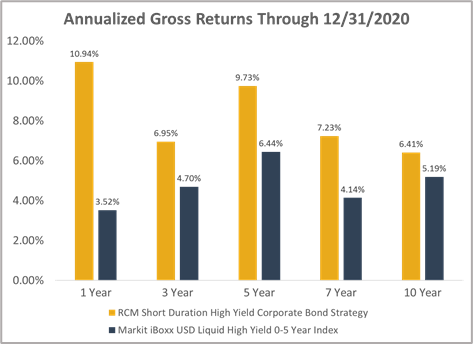

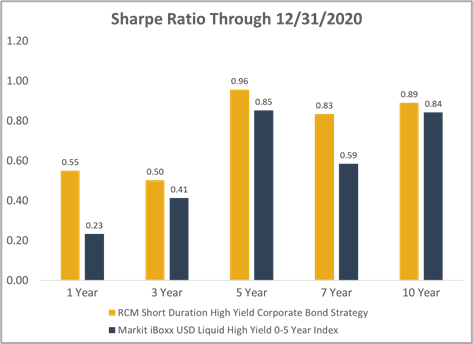

- RCM’s short duration high yield corporate composite continued its decade long trend of outperforming its target benchmark (Markit iBoxx US Liquid High Yield 0 – 5 Year Index).

- Completed development on the company’s trading and portfolio optimization engine. This web application allows management to not only quickly and efficiently put our clients’ capital to work as cash becomes available but also take advantage of trading opportunities to increase yield at the individual account and composite level.

- Significant continued investments in best-in-class partners like Clearwater Analytics and ACA Compliance as well as 3rd party service providers like RIA in a Box. These investments are made to ensure the company’s management can stay laser focused on investing your money while we continue to grow as a firm.

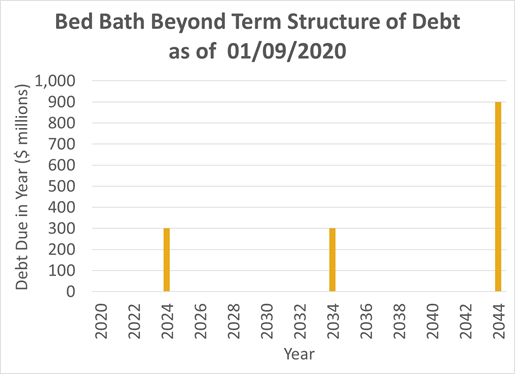

- Validated our investment framework against the most challenging environment the strategy has faced in the last decade. When the pandemic hit, we saw opportunities where others were selling. We bought, for example, Bed Bath & Beyond 3.749% of 8/01/2024 bonds at prices as low as 63 cents on the dollar that had been trading near par just a few weeks prior.

What gave us this conviction? First, the company’s term structure of debt (shown at right) provided incredible flexibility to management. Second, the company had a history of generating hundreds of millions of dollars in free cash flow annually and decisively adjusted its cost structure and working capital to address COVID-19. Third, cash on the balance sheet was more than $900 million providing 3X coverage on our debt. The bond has subsequently rallied back to over 100 cents on the dollar and RCM has begun monetizing its position and recycling client capital into higher yielding opportunities.

What gave us this conviction? First, the company’s term structure of debt (shown at right) provided incredible flexibility to management. Second, the company had a history of generating hundreds of millions of dollars in free cash flow annually and decisively adjusted its cost structure and working capital to address COVID-19. Third, cash on the balance sheet was more than $900 million providing 3X coverage on our debt. The bond has subsequently rallied back to over 100 cents on the dollar and RCM has begun monetizing its position and recycling client capital into higher yielding opportunities.

By any measure, 2020 was a turbulent year. Lockdowns, social distancing and working from home became the new normal. Wild swings in the economy and commodities / financial markets wreaked havoc in sectors like energy and retail. We always tell prospective clients that, while we are interested in market conditions, the investment strategy is business-cycle independent. This past year put that statement to the test. We feel fortunate to say we came out the other side more committed than ever to what we do. Since we have much of our own capital committed to the strategy, this fact is as important to us as fiduciaries to our clients as it is to our spouses and children.

Fixed Income Market Outlook 2021

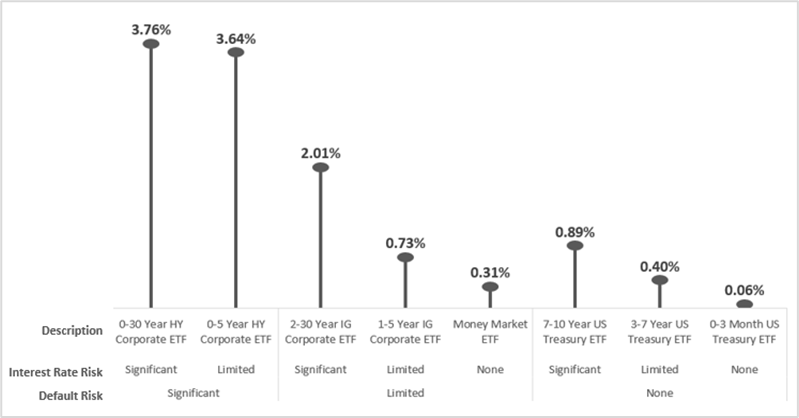

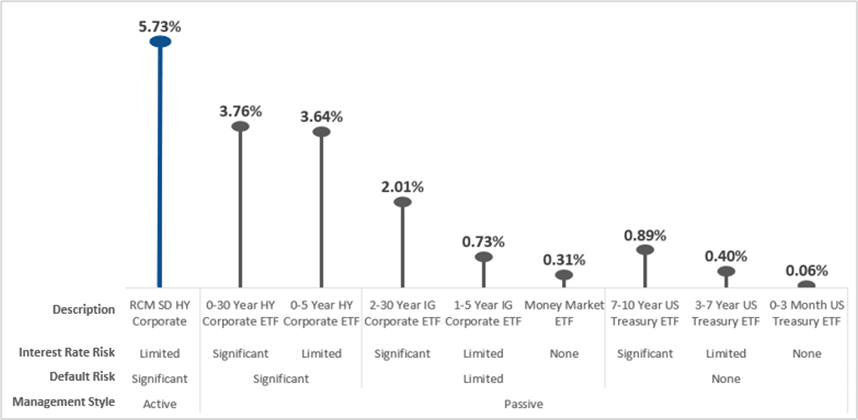

A wonderful characteristic about the fixed income marketplace is that, barring a default, one already knows their worst-case return at the time they deploy their capital assuming they hold the bond to its redemption. Below are yield-to-worsts of the underlying bonds of various passive products in the fixed income marketplace organized through the two primary risks that fixed income market participants face – interest rate and default risk (see note on last page for details).

These rates are at or near all-time lows. Why? The Federal Reserve wants to stimulate the economy because COVID-19 has stifled spending. It has does this by lowering interest rates, in what was an already low interest rate environment because of the Great Recession, to zero. What are the practical implications of this chart for today’s investor? Investors are not being compensated for taking interest rate risk - even small rate increases would result in unrealized losses that would take years to recoup, and investors are, on average, only being marginally compensated for taking default risk. So how should we think about near term interest rates and defaults? There is a high probability that effective vaccines, pent up consumer demand, a blue wave, additional fiscal stimulus, and highly accommodative monetary policy will equal more spending which will equal near term growth. That bodes very well for low default rates but raises concerns for higher inflation and interest rates.

Equity Market Outlook

The low fixed income rates have driven many savers into the equity markets. How should one reasonably expect equities to perform over the next decade or so? Even if we are wildly optimistic in our assumptions, forward equity returns will likely lag their historical averages by a significant margin. Why is this? Again, the answer is low rates. Since 1980, the growth in the P/E ratio for the S&P 500 Index has been nearly exactly inverse to the level of the 10-year U.S. Treasury interest rate. In other words, the lower the interest rate, the higher the P/E ratio. If we assume earnings growth and dividend yields are in line with historical averages and that the P/E ratio of the index will remain where it currently is over the next 10 years, then an investor will achieve an annual return of ~ 7%. If we assume that interest rates will rise thereby driving equity valuations back to historical averages, the annual equity return drops to ~ 3%. JPMorgan Asset Management, as of 11/20/2020, forecasted global annual equity returns for the next decade of 5.5%.

RCM Outlook

How are we responding to this outlook? As we have already mentioned, RCM’s investment strategy is business-cycle independent. As the diagram below shows (see note on last page for details), the yield to worst on our corporate composite is currently 5.7%, approximately 2 points better than the underlying bonds of the comparable 0 – 5 Year HY Corporate ETF.

The 5.7% yield is the return on the portfolio if we were to hold every bond to its redemption whereas the total return of the portfolio incorporates capital gains achieved through active management. Capital gain in a bond is generated by selling the bond at a lower yield than its purchase yield. Over the last decade we have been able to add ~ 1.5% of return over and above the yield to worst, implying a total expected return of 7.2%.

Several investors have asked how higher inflation and interest rates would impact the return on their portfolios. Because the bonds we buy are short duration, they are not as sensitive to higher interest rates as medium or longer duration bonds, would pull to par relatively quickly, and most importantly, the significant principal generated each year would be redeployed by RCM at higher yields. So, in short, we believe higher inflation and interest rates will quickly allow us to achieve higher returns for investors.

Of course, past or forecasted returns are not indicative of future performance, but we will strive to use every tool of active management in our tool kit - default risk management, expected return assessment, portfolio optimization and portfolio construction - to achieve excellent results for our investors.

Please reach out to us with questions and comments. Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

The performance and characteristics information contained herein is for accounts solely managed by David Roosevelt, Managing Member of Roosevelt Capital Management LLC. Investment performance and characteristics through September 2019 are for Roosevelt Investments accounts managed by David Roosevelt. Investment performance and characteristics for October 2019 and thereafter are for Roosevelt Capital Management accounts managed by David Roosevelt. The performance information has been certified by ACA Compliance through December 31, 2018 and is available upon request. The values and performance information contained herein do not reflect management fees. While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the reports, values, calculations or assumptions and encourages each prospective investor to conduct their own review of the reports, values, calculations and assumptions.

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)