February 2024 - How to Get a Lump Sum of Long-Term Capital Invested in the Market Without Losing Sleep

February 27, 2024

Dear Investors and Friends,

Warren Buffet, when talking about the demise of Long-Term Capital Management, once commented that, “…to make money they didn’t have, and didn’t need, they risked what they did have, and did need. That is foolish.” For most of us, however, our investing lives are much more mundane, and we more or less turn this quote on its head. If there has been one mistake that otherwise thoughtful investors, including Mike and I, consistently make, it is that, “We refused to risk money we did have, but did not need, to make money we did not have, but might someday need.” That is not foolish, but it certainly leaves a lot of money on the table over decades.

This problem is particularly acute in those moments in life when we find ourselves with a lump sum of long-term capital available to invest and a rising market in which to invest it. A case in point is that US investors currently hold nearly $13 trillion in money market funds and uninsured bank deposits combined.[1] A portion of these funds are obviously part of an intentional cash reserve, earmarked for upcoming liabilities or are simply providing investors with “dry powder” for opportunities on the horizon. However, it is almost certainly also true that a significant portion of this $13 trillion is sitting in cash or cash-like instruments purely out of uncertainty about the future and fear of getting into the market “at the wrong time.”

The purpose of this letter is to provide an analytically based framework with which to think about how to invest a lump sum of long-term capital into the market to minimize the impact of a drawdown and maximize the ability to sleep at night while also achieving an acceptable return.

The Cost of Risk Mitigation Via Dollar Cost Averaging

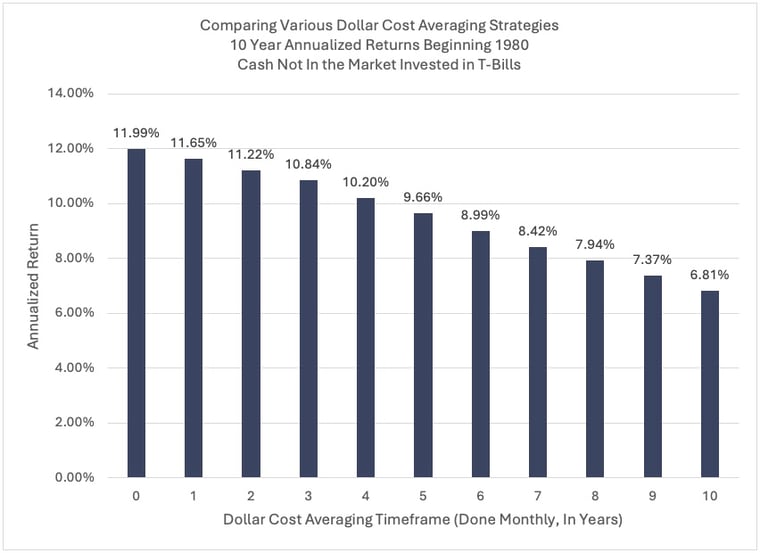

Let’s start with a simple question. If you find yourself with a lump sum to invest and are thinking about putting that money in equities, what is the “cost” of dollar-cost-averaging that lump sum over a period of years? The chart below shows exactly that analysis for 10-year returns beginning in 1980. Not surprisingly, the longer the investor stays in T-Bills instead of equities the lower his or her return has been to the tune of about 50 bps per year on average. So, from a purely mathematical standpoint, the highest average return, in the absence of any other information, would suggest the investor move the entire lump sum into the market as soon as it is received.

What About a Drawdown?

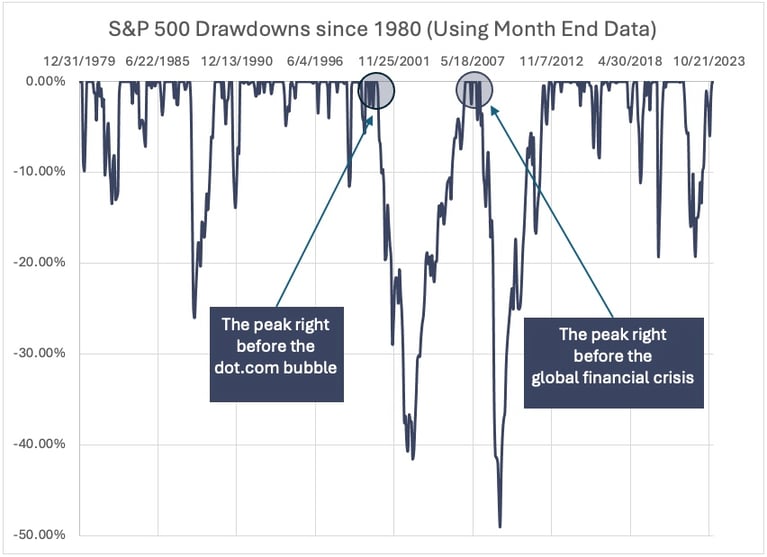

The problem, of course, is that the chart above displays the average return over 10 years across hundreds of entry and exist points over nearly 45 years, and averages can cover up a lot of problems. What if, instead, you were standing at the precipice of the dot com bubble or the global financial crisis?

Had you invested a lump sum right before the global financial crisis you were down nearly 50%! This fear, that right now you are investing at the peak of the market right before a major downturn, is the fear that has prevented us and others from entering the market. This is not so farfetched given that the S&P 500 is sitting at an all time high.

Optimal Strategy When Investing a Lump Sum Right Before The Global Financial Crisis

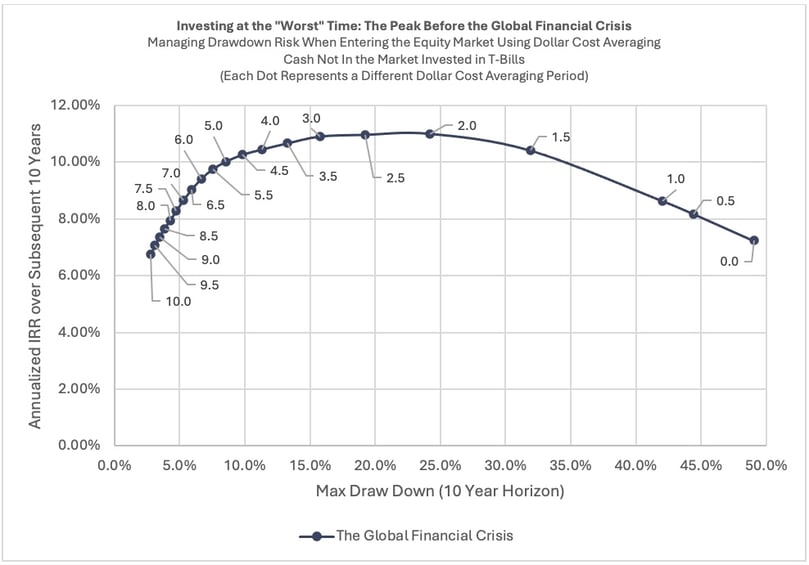

If you had money that you were required to deploy right before the GFC and could use dollar cost averaging to reduce your drawdown, what would the optimal strategy have been? Please look at the graph below.

One of the fascinating insights from doing a deep dive into this problem over the past few months is that, in both major downturns of the last 25 years, a dollar-cost-averaging strategy of around 3 to 5 years tended to be right around the optimal strategy. To be clear, the investor still experienced a drawdown but less than half of what they would have experienced had they simply invested in one lump sum. Unsurprisingly, the opposite is also true in that an investor that was too conservative, investing over 7 – 10 years, did limit their drawdown but significantly negatively impacted their return.

Key Take Aways

- If one had a lump sum of long-term capital to invest right before the global financial crisis, the optimal strategy would have been to dollar cost average over 3 to 7 years depending on how conservative the investor is relative to potential drawdowns,

- Coupled with a thoughtful fixed income strategy that performs above Treasuries, the investor can further insulate themselves from drawdowns in the market during the dollar-cost-averaging period, and

- RCM has the ability to construct, maintain and monitor equity portfolios that meet both of these objectives on top of our actively managed fixed income strategy.

Please reach out to us with questions and comments. Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the values, calculations or assumptions and encourages each prospective investor to conduct their own review of the audits, values, calculations and assumptions.

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)