December 2023 - Why We Love Munis

December 21, 2023

Dear Investors and Friends,

While RCM has a 14-year track record in municipal bonds, for the last several years we generally discouraged municipal bond portfolios for our clients. There are variety of factors that influenced this decision, but they all flow back to one basic issue – since about 2015 the expected returns on municipal bonds were simply lower than other fixed income products on a risk adjusted basis. That all started to change about a year ago and, with the back up in rates, we are excited about opportunities to allocate new and existing client capital to municipal bonds. In this letter we will discuss why we love the current muni market, our past performance in it, how RCM adds value and our current positioning.

Why We Love Municipal Bonds

Municipal bonds make up a $4 trillion market, comprised of approximately 50,000 unique issuers, largely owned by retail, rather than institutional, investors. For comparison there are approximately 3,000 unique publicly traded equities. Think about that for a second, nearly 17X the number of issuers! The sheer number of muni issuers, and the resulting market fragmentation, combined with the back up in rates, has now translated into a significant opportunity for the savvy investor to outperform the market.

RCM’s Past Performance

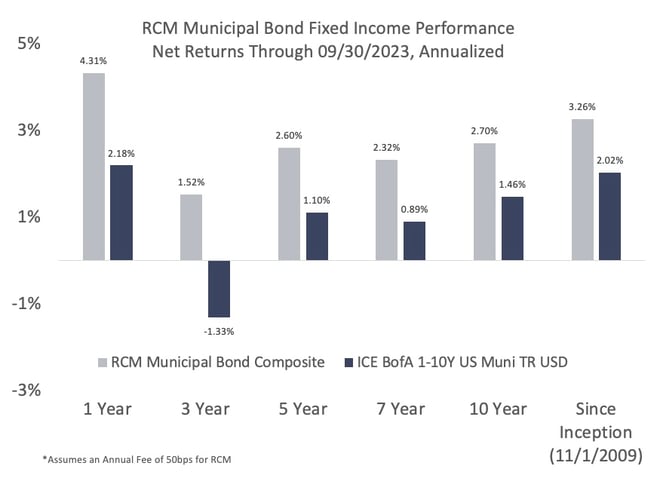

RCM has a 14-year muni track record of significantly outperforming its benchmark and generating meaningful returns in what has largely been a zero-interest rate environment.

![]()

Critically, RCM’s track record reflects materially lower risk than its benchmark and peers when evaluated through a lens of Sharpe ratio, Sortino ratio, Omega ratio, standard deviation, up and down capture and beta.

How RCM Adds Value in Munis

There are 5 key ways that RCM adds value in municipal bonds.

- RCM scours the market for smaller / niche / investment grade credits trading at yields materially above the market.

- RCM has experience doing deep credit analysis on individual muni credits.

- RCM has relationships with niche muni underwriters and brokers which gives it access to unique opportunities.

- RCM works to buy on the bid side via participating in “bids wanted in comp”.

- RCM is a boutique, which in practice means that it can add value relative to the market, which its larger peers cannot do.

RCM’s Current Positioning

Below we compare the tax-equivalent yield of RCM’s muni portfolio to the major sectors of the investment grade fixed income marketplace: Treasuries, Agencies, Munis and Corporates. Please note for comparison that the average rating of RCM’s muni portfolio is single A.

.jpeg?width=671&height=491&name=Image%2012-20-23%20at%206.18%20PM%20(1).jpeg)

The key takeaway from this chart is that the tax equivalent yield on RCM’s muni portfolio is approximately 1% better than lower rated corporates and nearly 2% better than equivalent rated munis.

Final Thoughts

The beautiful thing about the fixed income markets is that an investor knows exactly what their return will be before they allocate capital, barring a default. The fragmentation of the muni market combined with RCM’s repeatable processes gives us confidence that we will continue to outperform the market in the future as well.

Please reach out to us with questions and comments. Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the values, calculations or assumptions and encourages each prospective investor to conduct their own review of the audits, values, calculations and assumptions.

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)