August 2023 - Active Cash Management

August 01, 2023

Dear Investors and Friends,

At Roosevelt Capital Management (RCM), we are active managers of fixed income securities including U.S. Treasuries. Most people understand the first part of that sentence but struggle to understand how Treasuries can be actively managed. So much so in fact, that one of us had dinner recently with an individual that simply did not believe it. The purpose of this month’s letter is to provide an overview of what it means, at least for RCM, to actively manage US Treasuries and what the actual benefits have been since we have started our US Treasury Cash Management Composite.

Benefits of US Treasuries Active Management

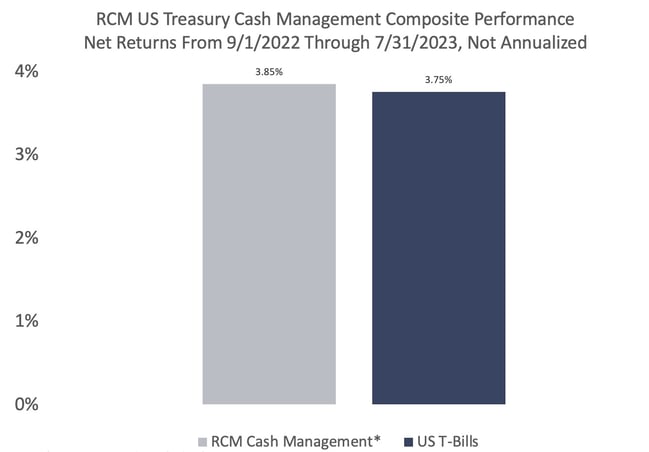

Over the last 11 months, RCM’s US Treasury Cash Management strategy has outperformed T-bills (short-term U.S. government debt obligations with maturities of one year or less), net of fees, by 10 bps. Think about that for a second. In arguably the most liquid market in the world, RCM covered its fees and added 10 bps of value.

While the absolute benefit over and above the index is small, the purpose of our Treasury product is first and foremost to protect our clients’ capital. Given that objective, we believe covering our fees and adding 10 bps of value is a significant benefit.

*Assumes an Annual Fee of 25bps for RCM

To be clear, this type of opportunity – covering our fees and then adding incremental value – will not always exist but the strategy will always perform at least as well as a passive investment in short duration U.S. Treasuries so there is no downside to active management. How do we do this? We provide this value in four ways.

Curve Placement

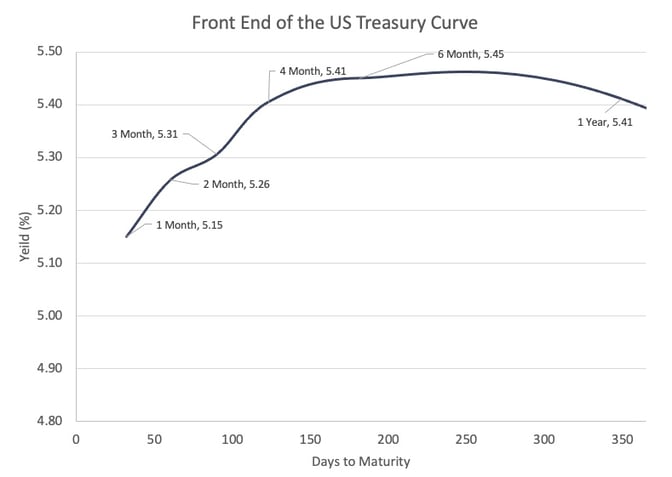

The first way RCM adds value in a Treasury portfolio is simply by curve placement. What do we mean by this. Below is a graph of the front end of the US Treasury curve as of 6/30/2023.

As you can see, it slopes upward and then after 6 months becomes inverted. RCM places client capital at the optimal part of the US Treasury curve taking market yield, market risk and client constraints / objectives into account.

Market Inefficiencies

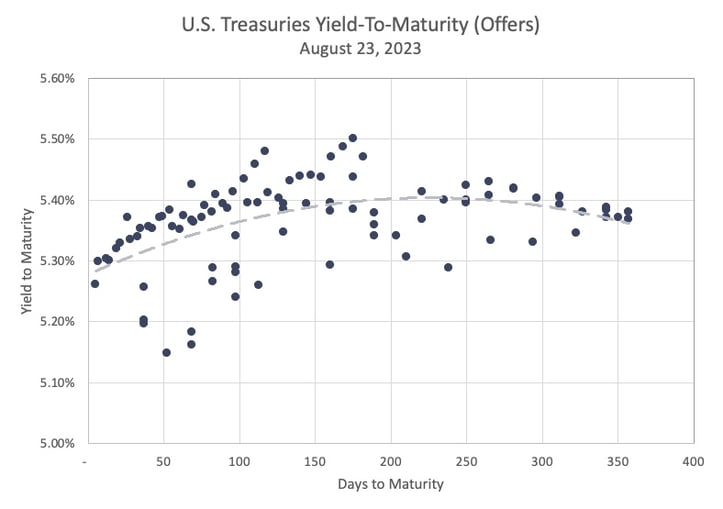

The second way RCM adds value in a Treasury portfolio is through buying the highest yielding bond in a targeted maturity range. A surprise to many, there can be and frequently are inefficiencies in the U.S. Treasury market, albeit relatively minor ones. Investors, even professionals, too often view the yield curve as if it were a “price list” where the buyer simply picks a point on the curve and then purchases a Treasury at that yield. The reality is that the yield curve is a mathematical approximation of the real-world yields available in the market for actual bonds. And the real world is still a bit messy even with U.S. Treasuries. Shown below is the actual market to buy U.S. Treasuries on the morning of August 23rd for maturities out to one year, along with an approximation of the yield curve over this same period.

As you can see, the offer yield on bonds with nearly identical maturities have variances that, if you are trading frequently, add up over time.

Optimization

The third way we add value is through optimization. Optimization is the process of selling a security before it matures and buying a new security of the same or similar maturity at a higher yield. By doing this RCM increases the client’s total return. The benefits of optimization are particularly noticeable when compared to security “laddering.” Unlike a laddered portfolio where the investor waits until a bond matures, then re-invests the cash, RCM is constantly looking for opportunities to replace lower yielding securities with comparable higher yielding securities, thereby increasing the total return on the portfolio.

Bucketing

The fourth way we add value in Treasuries is through managing our clients’ liquidity “buckets” at a very granular level. RCM has built proprietary technology and systems to allow us to do this for clients effectively and efficiently. For example, if a client comes to us having both unconstrained cash reserves as well as liabilities coming due at known times (i.e., taxes, closing on a business purchase, etc.), we segregate each of these liabilities within the same custodial account but allocate the client capital to match the various liabilities.

This benefit is less about optimizing return, although we do that in these fixed liability buckets too, and more about the peace of mind the investor has knowing the cash for their upcoming liabilities is going to be available on the day they need it without having to manage it themselves.

Summary

When RCM launched our US Treasury Cash Management Strategy, we thought clients would like it because we could generate relatively higher returns with lower risk than they could do for themselves. What surprised us was that clients utilize the strategy primarily because it frees them from having to think about and deal with cash management. RCM makes cash management turnkey; all clients need to do is let us know that they need to wire out some or all their cash and we make it available to them.

Please reach out to us with questions and comments. Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the values, calculations or assumptions and encourages each prospective investor to conduct their own review of the audits, values, calculations and assumptions.

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)