August 2022 - New Opportunities for Cash

August 18, 2022

Dear Investors and Friends,

With nominal interest rates near zero for the past several years, many investors have had relatively significant portions of their “liquidity bucket” just sitting on the sidelines. Bank accounts, money market funds and even CD-based strategies offered relatively safe places to park cash albeit with little to no nominal return. Because interest rates and inflation were so low, the opportunity cost for this type of strategy was limited.

Markets have changed dramatically in the last several months, however, and sitting in cash no longer comes without a significant penalty. As of this writing, the 3-Month Treasury Bill is trading at 2.60% and the 6 Month Treasury Bill is at 3.10%. Every dollar you, as an investor, have sitting in cash could be earning interest. The world has changed.

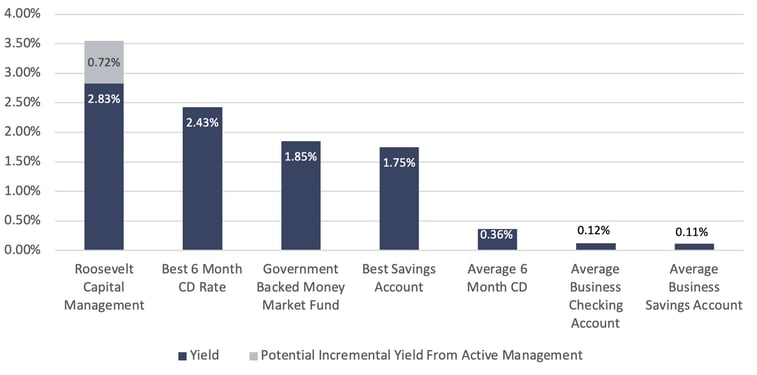

To address this shift in the market, Mike and I would like to announce a new product – Roosevelt Capital Management Government Backed Liquidity Management Portfolios. The product has two key features. First, we invest clients’ funds, using a Separately Managed Account (SMA), directly in laddered Treasury portfolios with a maturity profile that meets the client’s specific needs. Second, we layer on top of the initial investments the same optimization methodology we apply to our other fixed income product with the potential to improve yield as much as 72 basis points in the current environment.

Why the RCM Government Backed Liquidity Management Portfolio?

One of our primary objectives at Roosevelt Capital Management (RCM) is to democratize fixed income investing. As a short-term liquidity management tool, we believe there is no better vehicle today than U.S. Treasuries whether the investor is a retired schoolteacher or a sovereign nation with literally billions of dollars in cash. The practical challenge for most investors in implementing this strategy is some combination of: a) a lack of understanding about the mechanics of buying and selling Treasuries, b) the time to manage the investment once it has been made, and c) the infrastructure to maintain, monitor and optimize the portfolio on an ongoing basis. What RCM offers is experience and expertise in all three areas. Additionally, because we operate through SMAs and not a fund structure, we can tailor the liquidity product to the individual investor and further seek to provide a higher total return even after fees than they could get through other short-term liquidity products available today.

Key Benefits to the Investor

- Low Risk: A U.S. Treasury carries the full faith and credit of the U.S. government

- Highly Liquid: The U.S. Treasury market is arguably the deepest and most liquid in the world

- Customizable: SMA allows for laddered maturities tailored to the individual investor

- Maximizes Flexibility/Optionality: No lock up period

- Incremental Yield Potential: Take advantage of RCM’s optimization model

Please reach out to us if are interested in learning more and thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

Notes and Disclaimers

Annualized Yield of Liquidity Products

- Data as of 8/12/22

- Roosevelt Capital Management Yield is for the 6 month Treasury less RCM's fee

- Roosevelt Capital Management potential incremental yield from active management assumes the Treasury yield curve does not change

- Government Backed Money Market Fund is the Schwab Government Money Market Fund (SNVXX)

- Average 6 Month CD data source: https://www.depositaccounts.com/cd/6-month-cd-rates.html

- Average Business Checking Account data source: https://www.depositaccounts.com/checking/business-checking-accounts.html

- Average Business Savings Account data source: https://www.depositaccounts.com/savings/business-savings-accounts.html

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Yields may not be indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target yields will be achieved, or objectives will be met are implied. Future returns may differ significantly from indicative yields due to many different factors. Investments involve risk and the possibility of loss of principal.

While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the values, calculations or assumptions and encourages each prospective investor to conduct their own review of the values, calculations and assumptions.

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)