August 2021 - Uncertainty & Decision Making

August 01, 2021

“There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.” John Kenneth Galbraith

We live in an unpredictable world, but this fact does little to dissuade people from making predictions. A recent poll by the Financial Times, for example, asked 52 economists the likelihood that the U.S. Federal Reserve will raise rates by at least 50 basis points by the end of 2023. Answers generally favored a rate hike, but the entire spectrum of answers ranged from a probability of 0% to 100%. To be fair to the respondents, there are a lot of contradictory signals in the global economy today like low consumer sentiment, higher inflation, supply chain shortages and the Delta variant of COVID, to name a few. Still, 0% to 100% literally covers the range of every possible answer and from just a few dozen individuals that think about questions like this for a living, in other words, the “experts!”

Even when all the signals are aligned, one should not delude themselves and think they know how things will play out. For instance, even in the depths of COVID at the end of March 2020, when the world’s outlook looked uniformly bad, equities began climbing. There was nothing special about March 24th vs March 23rd, the day the S&P hit its low, but the market nonetheless started climbing again. Would anyone have predicted this outcome even though all the economic indicators were consistent and unchanged?

So, if it is pointless to predict the future, what options does an investor have? In the case of fixed income investing, where the range of possible outcomes is generally well understood at the time the investment is made, one might take any number of approaches. We discuss three, including the most common in today’s market.

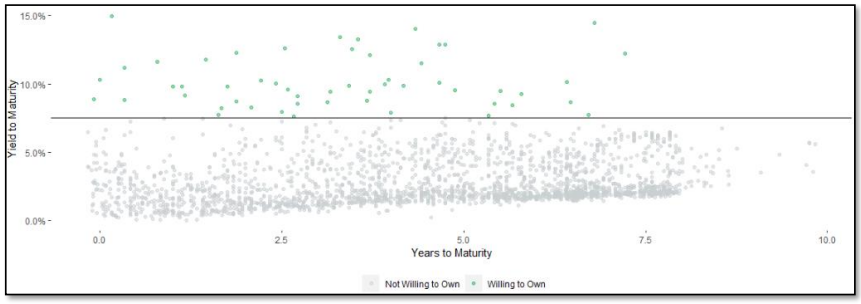

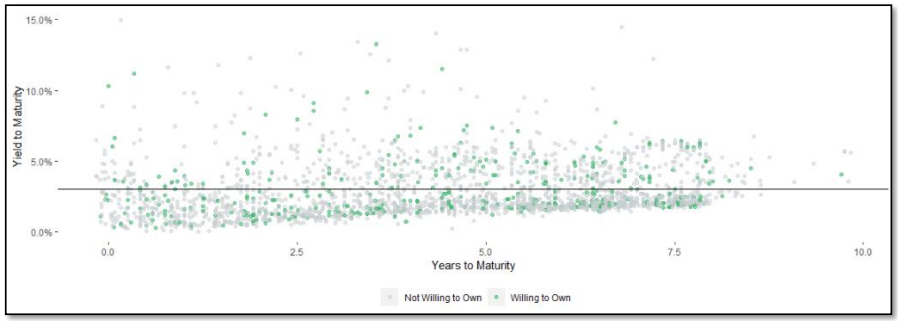

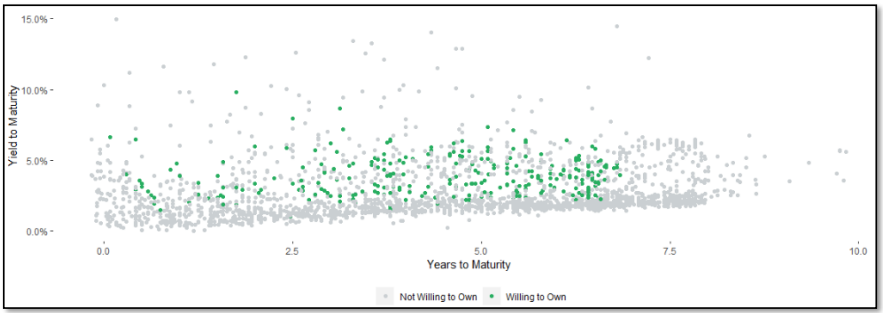

Note: In each of the charts below, a dot represents a bond, collectively all the dots represent the universe of bonds, and the green dots represent the bonds that one would buy in executing the strategy.

Strategy #1: Rules-Based Investing

One could simply buy the highest yielding bonds.

The problem with this approach, of course, is obvious - higher yields generally indicate higher risk. The probability that one or more of these bonds will default is likely higher, otherwise everyone would do this.

In fact, risk neutral pricing, a concept we may dive into in a future letter, dictates that in an efficient market an investor should receive the same return in a risky asset, after expected losses, as he or she would receive in a riskfree asset. While investing in many of these bonds would likely turn out fine, it’s also likely that some of them would default.

Strategy #2: Buy a Representative Sample of the Market

The second strategy is to buy bonds that replicate the performance of the market.

This is analogous to many passively managed ETFs and mutual finds that follow an “indexing” strategy. The problem here is that you are buying many low yielding bonds unnecessarily without really gaining anything in return for the loss of yield.

Strategy #3: Take an Active Management Approach that Relies on Probability

Superficially, this strategy may look like a random sample indexing approach, but it could not be more different.

This strategy evaluates every bond in the universe. Specifically, it:

- Eliminates bonds with high probabilities of default for which an investor is not compensated,

- Eliminates low yielding bonds,

- Eliminates bonds that fail manual due diligence,

- Monitors each bond daily,

- Sells bonds if their probabilities of default increase to unacceptable levels, and

- Sells bonds that appreciate if there is an opportunity to re-deploy the capital to “higher” return / acceptable default risk opportunities

What is left is a relatively small but optimal subset of bonds in which to invest. As the chart below shows, this strategy, which has been utilized by Roosevelt Capital Management (RCM), has consistently beaten the corresponding index for over a decade.

What Does this Mean for RCM Investors?

At RCM we will never try to predict the direction of the economy, interest rates or the markets because history has taught us that doing so is futile. However, an unknown future and uncertain outcomes are not excuses for not making thoughtful decisions. An active management approach that relies on a probabilistic framework helps us to differentiate between bonds we want to own and those we do not. Occasionally, we will be wrong, and sometimes dramatically, however, experience has demonstrated that if we are thoughtful in our approach and disciplined in its execution, we can expect to meaningfully outperform the market.

Please reach out to us with questions and comments. Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

The performance and characteristics information contained herein is for accounts solely managed by David Roosevelt, Managing Member of Roosevelt Capital Management LLC. Investment performance and characteristics through September 2019 are for Roosevelt Investments accounts managed by David Roosevelt. Investment performance and characteristics for October 2019 and thereafter are for Roosevelt Capital Management accounts managed by David Roosevelt. The performance information has been certified by ACA Compliance through December 31, 2018 and is available upon request. The values and performance information contained herein do not reflect management fees. While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the reports, values, calculations or assumptions and encourages each prospective investor to conduct their own review of the reports, values, calculations and assumptions.

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)