April 2022 - Q1 2022 Performance Review

April 12, 2022

By now you are no doubt tired of hearing that inflation has climbed to its highest level since the 1970s. There is extreme upward pressure on wages with unemployment nearly back to pre-Covid levels, supply-chain problems are not unwinding as quickly as hoped creating unprecedented shortages in certain goods, and the Russian invasion of Ukraine exacerbates inflation. All these factors serve to make what has become a hawkish Fed even more aggressive. The result has been an extraordinary rise in certain parts of the Treasury yield curve. The 2-year Treasury has increased from 0.14% on May 25th, 2021, to 2.54% on April 8th, 2022. The last time we saw such a quick rise in rates was in early to mid-1981, the Paul Volcker era. What are most investors learning from this rate move? Because of the steep mark to market losses incurred, they have learned that interest rate risk, something we have been writing about since before this rate move, is real.

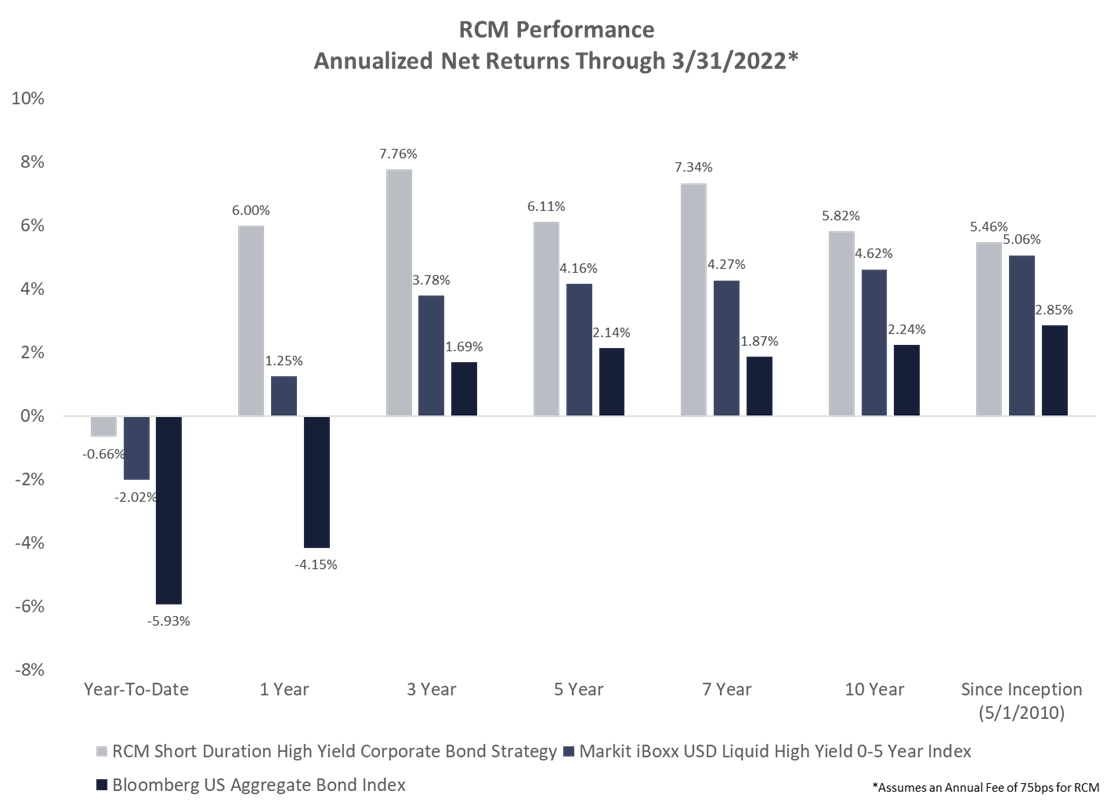

Below is a comparison of RCM’s performance vs. two bond indices. Think of the Bloomberg US Aggregate Bond Index as the “S&P 500” of the bond market. If you want to know how RCM did vs. “the bond market” compare us against this index. The Markit iBoxx USD Liquid High Yield 0-5 Year index holds bonds similar to those that RCM holds. If you want to know how RCM did against the short duration high yield bond market, compare us against this.

So how did we do? RCM has meaningfully outperformed the bond market and its index.

A few observations about the performance.

First, the “bond market” has been justifiably loathed. Driven by loose global central bank policy, the performance of the Bloomberg US Aggregate has been appalling. The only reason to have been in “the bond market” would have been because you had so much capital (e.g., sovereign wealth funds) that your problem is finding places to put it to work. It is fair to say that this is not most people or organization’s challenge.

Second, there are “pockets” of opportunity in bonds. Just because “the bond market” is generally unappealing does not mean that all bonds should be ignored. The Markit iBoxx USD Liquid High Yield Index significantly outperformed the bond market over all time periods while taking significantly less interest rate risk. Granted, high yield bonds have default risk which, if not managed well, could lead to significant losses. This is the risk that RCM specializes in managing.

Third, after fees, RCM has consistently outperformed the bond market and its index. We do this through active management that includes constructing portfolios with higher yields than the index, with less losses than the index, and that are constantly being optimized.

Fourth, short duration high yield corporate bonds have been one of the most attractive areas of not only the bond market, but the financial markets in general. Because of their low interest rate risk and a very benign default environment, year to date short duration high yield corporate bonds have outperformed not only other fixed income sectors but also the equity market and hedge funds.

What Does the Future Hold?

Starting in mid to late March, parts of the Treasury yield curve began to invert. Inverted curves have frequently, but not always, been harbingers of economic slowdowns. Without going into the details, but referencing our June 2021 commentary on forward rates, an inverted yield curve suggests a reversal in Fed policy. Could a recession be looming? An environment of high inflation and aggressive Fed policy certainly increases the probability of a hard landing. What does this mean for RCM and the way we manage client portfolios? Bond math tells us that the worst-case return that we will get on a bond if we hold it to redemption is its yield to worst at the time of purchase, barring a default. Those last three words, barring a default, are the key; we have been and will continue to be laser focused on understanding the underlying default risk of each bond in the portfolio in an effort to avoid realized losses from credit deterioration. While a recession would certainly result in short term credit spread widening and losses, managed effectively, it would ultimately allow us to generate greater profits for investors as we optimize capital into the highest yielding opportunities. The brief but deep recession caused by the pandemic is an example of us doing this.

Please reach out to us with questions and comments. Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

The performance and characteristics information contained herein is for accounts solely managed by David Roosevelt, Managing Member of Roosevelt Capital Management LLC. Investment performance and characteristics through September 2019 are for Roosevelt Investments accounts managed by David Roosevelt. Investment performance and characteristics for October 2019 and thereafter are for Roosevelt Capital Management accounts managed by David Roosevelt. The performance information has been certified by ACA Compliance through December 31, 2018 and is available upon request. The values and performance information contained herein do not reflect management fees. While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the reports, values, calculations or assumptions and encourages each prospective investor to conduct their own review of the reports, values, calculations and assumptions.

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)