April 2021 - The Merits of Short Duration High Yield in Today’s Investment Climate

April 01, 2021

Fixed income investors are taking a beating these days as evidenced by the Barclays Aggregate Q1 2021 performance of -3.37%. While there are myriad reasons for this situation, they can pretty much all be summed up in a recent comment by Bridgewater’s Ray Dalio who said, “Bond markets offer ridiculously low yields…(and) the economics of investing in bonds (and most financial assets) has become stupid.” For the most part, we agree with this sentiment. So why are we continuing to deploy both our own and our clients’ capital in short duration high yield corporate bonds if fixed income investing is currently so fraught with potential problems? The purpose of this letter is to address that question.

Equities: Not Exactly A Bargain

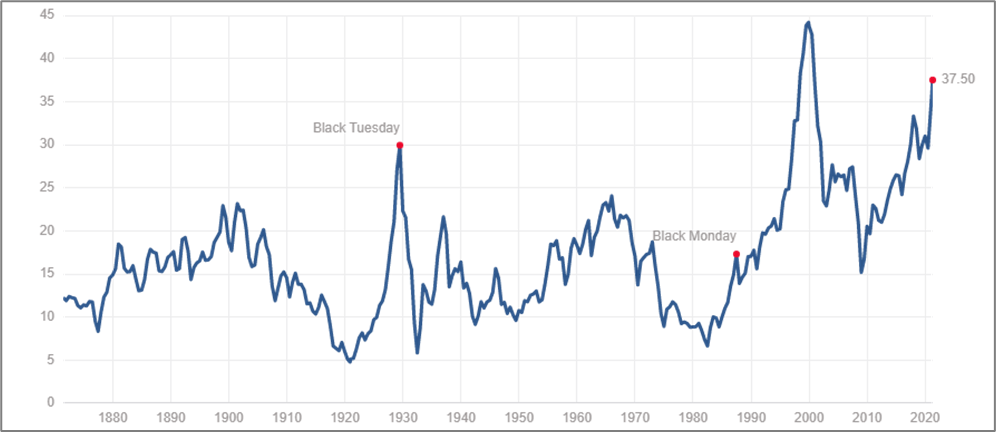

Let us start by looking at alternatives. Mr. Dalio’s comment above was specifically targeted at bonds, but you may have also noted that he mentions “most financial assets” as potentially problematic as well. While no single fact about the market is perfect, at Roosevelt Capital Management (“RCM”) we strive to find simple metrics that are generally reliable indicators of the state of the markets, and one does not need a finance degree to see that valuations are at or near all-time highs. Shown below is the Shiller PE Ratio for the S&P 500 for over 100 years. It has been higher than it is right now exactly once – just before the burst of the dot com bubble.

Shiller PE Ratio for S&P 500

Source: https://www.multpl.com/shiller-pe

At RCM, we make a point of never trying to predict the future if, for no other reason, than we have invariably been wrong when we did. Instead, we spend almost all our time thinking about probabilities and using our probabilistic models in an attempt to make good investment decisions. On that note, we believe that the probability of generating the same returns by owning a broad-based equity index over the next ten years, as compared to the last ten, is very low.

Cash: 2021 Is Not 2007

If an investor had a crystal ball in the summer of 2007, one perfectly rational response would have been to simply move to cash and wait. The problem with that strategy in today’s environment is that sitting on cash comes with several risks. Unlike the financial bubble in ’07, the economy appears to be legitimately gaining steam, labor markets appear relatively strong, and pent-up demand from Covid lock-downs is transforming into real demand in any number of goods and services markets. None of these factors, however, are particularly good signs for holding cash. In fact, quite the opposite.

In the United States, we are not at a point where returns on cash are negative, as they are in some other parts of the world. However, the massive tailwinds created by the relatively continuous 40-year decline in interest rates is likely coming to an end. Couple that with multiple rounds of COVID related stimulus under both the Trump and Biden administrations and the various signs that the economy is heating up as noted above, the probability of higher interest rates and inflation starts to look elevated. Neither of these outcomes is good for holding cash.

Rate on 10 Year US Treasury: 1980 to 2021

Source: https://www.cnbc.com/quotes/US10Y

Fixed Income: Passive vs. Active

If you accept that in the current environment equities are expensive, interest rates are likely to increase, and inflation is potentially on the horizon then why not move to fixed income securities? First, many fixed income investments come with significant interest rate risk. In fact, it was largely an increase in interest rates that led to the negative return on the Barclays Aggregate in the first quarter. Second, just like the equity markets, fixed income investors who blindly invest in high yield bonds are generally not being well compensated for taking default risk. It is these two facts that are leading well respected investors like Ray Dalio to Warren Buffet to make the statements they are about bonds. Again, we largely agree with them.

However, and critically for your portfolio and ours, we also believe that a wholesale avoidance of the fixed income market is throwing out the baby with the bathwater. Short duration high yield corporate bonds allow us to largely mitigate interest rate risk (see March 2021 newsletter for a deeper dive into this issue) and we address default risk through extensive quantitative screening, rigorous due diligence, and daily monitoring.

How Has RCM Performed?

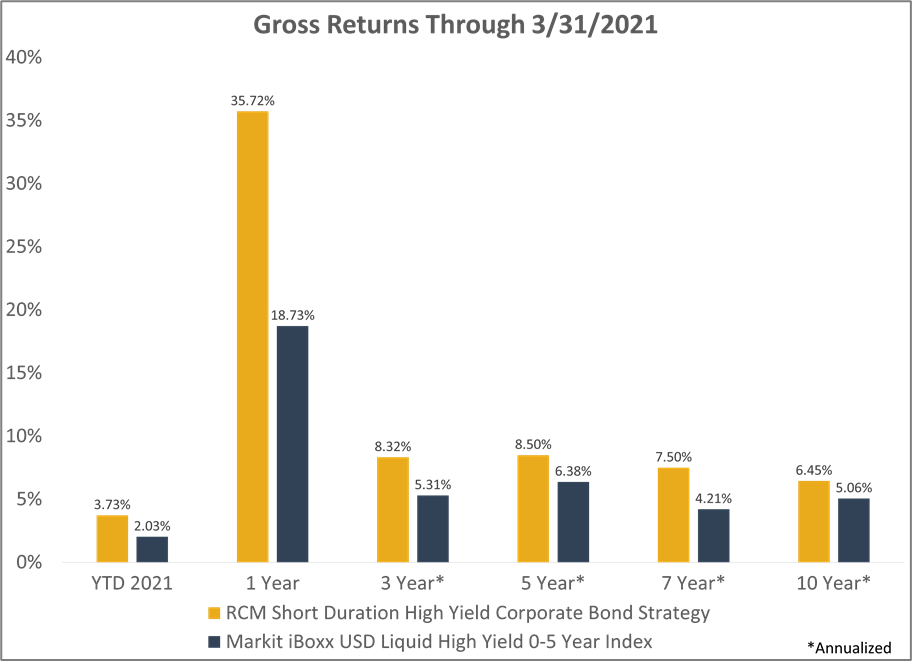

RCM’s short duration high yield corporate composite continued its decade long trend of outperforming its target benchmark (Markit iBoxx US Liquid High Yield 0 – 5 Year Index) with a year-to-date return through March 31 of 3.73% vs. 2.03%.

Note: While we are very proud of our one-year return and how we navigated the last year, we want to be very clear that one should not look at RCM’s one-year return and expect that future returns will look anything like it. That return was for the period 4/1/20 through 3/31/21 which excludes returns from February and March 2020, the months that were most negatively impacted by Covid. RCM’s one year return for the period 2/1/20 through 1/31/21, including the bad “Covid months,” was 11.91% vs. the index’s return of 4.09%, nowhere near the April 2020 to March 2021 results.

Conclusion

No investing strategy is without risk and RCM’s short duration corporate bond strategy is no exception. We work very hard to understand and quantify those risks knowing that we will occasionally be wrong. However, we also believe that, while our approach may not beat the index over the short term, over the long term, as in the past, our process-driven and disciplined methodology will generate returns that surpass the index.

Please reach out to us with questions and comments. Thank you for trusting RCM with your capital. It is a privilege for us to serve you.

David and Mike

Disclaimer

Roosevelt Capital Management LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. No guarantees or assurances that the target returns will be achieved, or objectives will be met are implied. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal.

The performance and characteristics information contained herein is for accounts solely managed by David Roosevelt, Managing Member of Roosevelt Capital Management LLC. Investment performance and characteristics through September 2019 are for Roosevelt Investments accounts managed by David Roosevelt. Investment performance and characteristics for October 2019 and thereafter are for Roosevelt Capital Management accounts managed by David Roosevelt. The performance information has been certified by ACA Compliance through December 31, 2018 and is available upon request. The values and performance information contained herein do not reflect management fees. While all the values used in this report were obtained from sources believed to be reliable, all calculations that underly numbers shown in this report believed to be accurate, and all assumptions made in this report believed to be reasonable, Roosevelt Capital Management LLC neither represents nor warrants the reports, values, calculations or assumptions and encourages each prospective investor to conduct their own review of the reports, values, calculations and assumptions.

- January 01, 2026 (1)

- December 01, 2025 (1)

- November 01, 2025 (1)

- October 01, 2025 (1)

- September 01, 2025 (1)

- August 01, 2025 (1)

- July 01, 2025 (1)

- June 01, 2025 (1)

- May 01, 2025 (1)

- April 01, 2025 (1)

- March 01, 2025 (1)

- February 01, 2025 (1)

- January 01, 2025 (1)

- December 01, 2024 (1)

- November 01, 2024 (1)

- October 01, 2024 (1)

- September 01, 2024 (1)

- August 01, 2024 (1)

- July 01, 2024 (1)

- June 01, 2024 (1)

- May 01, 2024 (1)

- April 01, 2024 (1)

- March 01, 2024 (1)

- February 01, 2024 (1)

- January 01, 2024 (1)

- December 01, 2023 (1)

- November 01, 2023 (1)

- October 01, 2023 (1)

- September 01, 2023 (1)

- August 01, 2023 (1)

- July 01, 2023 (1)

- June 01, 2023 (1)

- May 01, 2023 (1)

- April 01, 2023 (1)

- March 01, 2023 (2)

- February 01, 2023 (1)

- January 01, 2023 (1)

- December 01, 2022 (1)

- November 01, 2022 (1)

- October 01, 2022 (1)

- September 01, 2022 (1)

- August 01, 2022 (1)

- July 01, 2022 (1)

- June 01, 2022 (1)

- May 01, 2022 (1)

- April 01, 2022 (1)

- March 01, 2022 (2)

- January 01, 2022 (1)

- December 01, 2021 (1)

- November 01, 2021 (1)

- October 01, 2021 (1)

- September 01, 2021 (1)

- August 01, 2021 (1)

- July 01, 2021 (1)

- June 01, 2021 (1)

- May 01, 2021 (1)

- April 01, 2021 (1)

- March 01, 2021 (1)

- February 01, 2021 (1)

- January 01, 2021 (1)